We’ve ranked the top seven American neobanking apps based on downloads and compared them to some of the most popular mobile offerings from traditional banks.

One of the hallmarks of the modern fintech landscape is an underlying anxiety stemming from the impact of events like the great recession and the COVID-19 pandemic.

This disquiet played a pivotal role in the Wall Street Bets fiasco, where unsophisticated investors on Reddit and Twitter undermined short positions held by hedge funds and called for transparency from commission free investment apps like Robinhood. It also continues to underlie much of the online discourse around the long-term viability of Bitcoin, nun-fungible tokens (NFTs), and other cryptocurrencies and blockchain offerings.

Nevertheless, despite the clamoring for decentralized and democratized financial institutions, one of the more remarkable innovations in the banking sector often gets overlooked. Indeed, over the last few years, mobile banking has accelerated at unprecedented rates. And while traditional banking institutions were the first to develop digital banking solutions, neobanks have put the old guard on notice.

To better understand the state of play in the mobile banking landscape, we leveraged our app intelligence solutions to analyze neobanking apps and their traditional banking counterparts. Here’s what we’ll cover:

- What is a Neobank?

- The Top 7 US Neobanking Apps on Google Play

- How Neobanking Apps Compare to Traditional Banking Apps

- Conclusion

What is a Neobank?

A neobank is a digital bank that does not have any physical branches. Rather, neobanking enables customers to organize their finances entirely via digital channels, such as mobile apps. They facilitate digital and mobile-first financial solutions, including payments, money transfers, money lending, and more.

Neobanks are also able to out-compete traditional banks on numerous levels. For instance, according to Sukhjot Basi, Co-Founder and CEO of Bank Yogi, neobanks benefit from maintaining lower barriers to entry than traditional banks. As such, they can provide banking services to individuals without a credit history, who lack stable employment, or who otherwise don’t qualify for traditional bank accounts.

The Top 7 US Neobanking Apps on Google Play

According to the latest download numbers, the most popular neobanks on Google Play are...

1. Chime – Mobile Banking by Chime

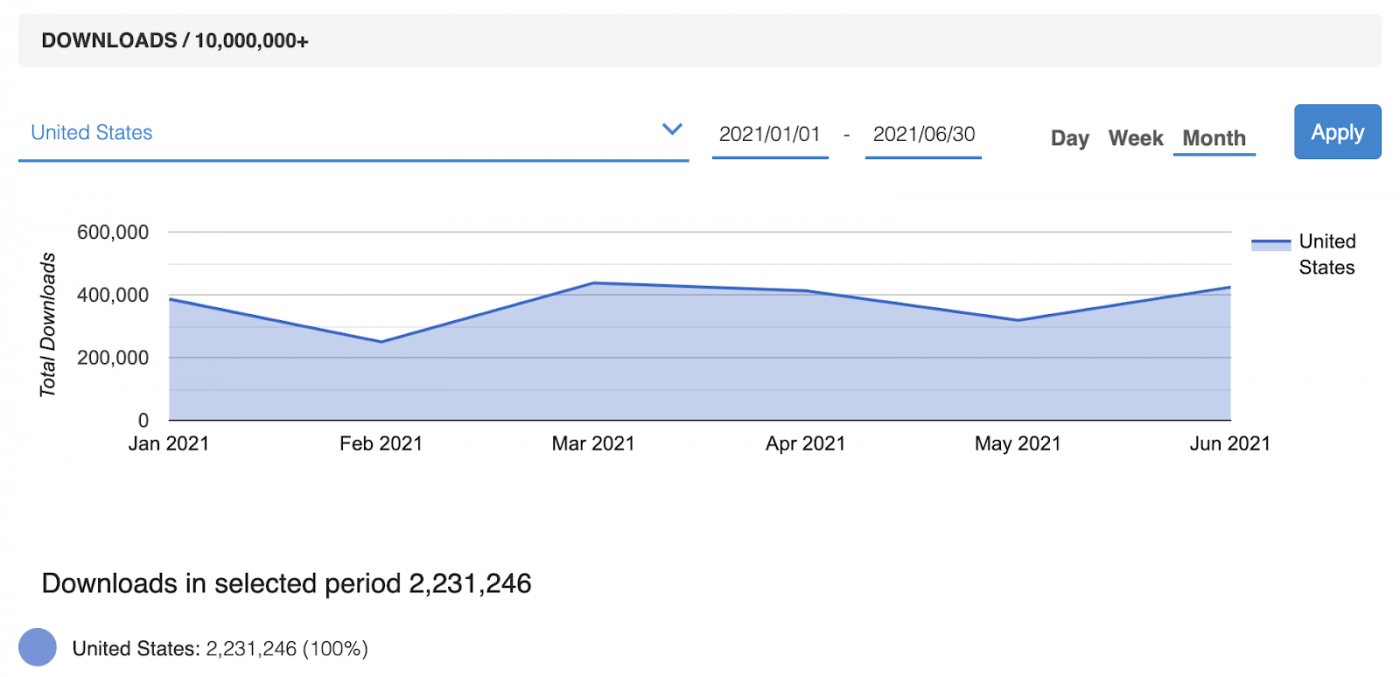

During the first six months of 2021, Chime – Mobile Banking was downloaded 2,231,246 times in the United States. See here:

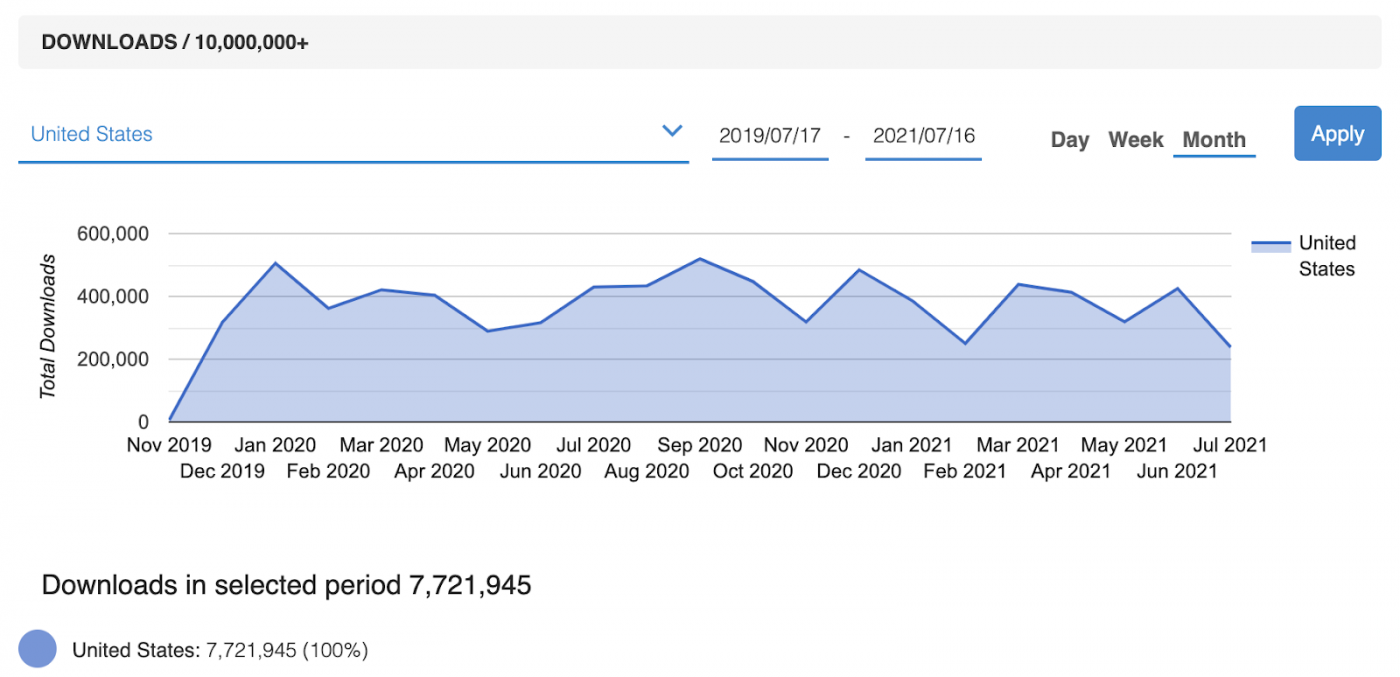

Over the last two years, Chime has been downloaded 7,721,945 times in the United States.

Based on our analysis of Chime’s reviews, the features that generate the most positive user sentiment are Notifications & Alerts, Tutorial, User Interface & UX, and Pricing & Payments.

2. Current - Modern Banking by Current

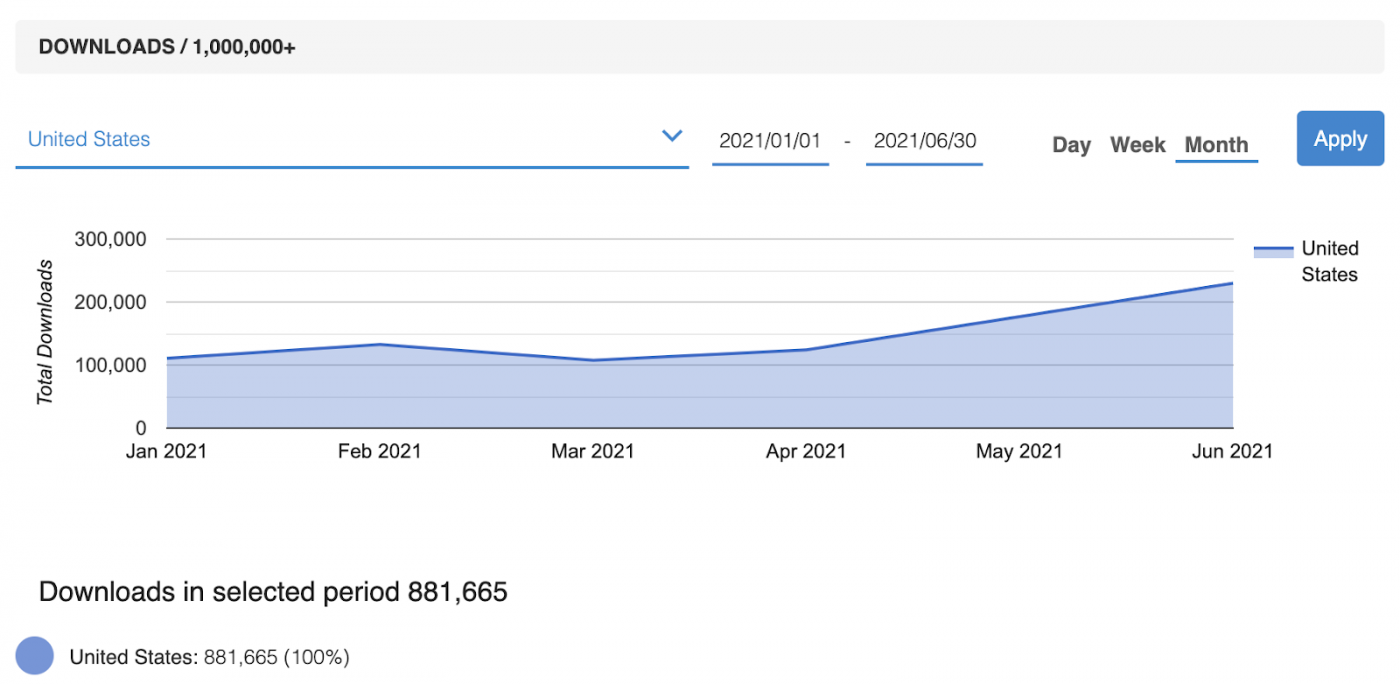

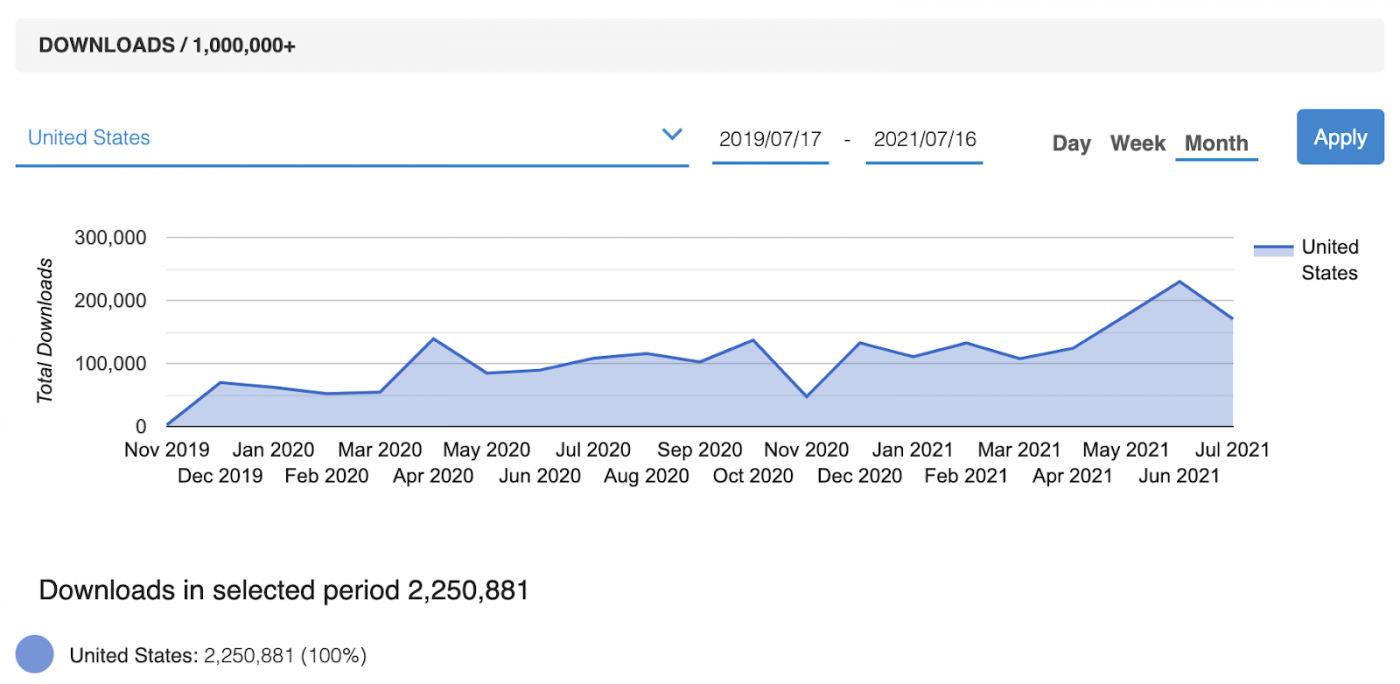

During the first six months of 2021, Current - Modern Banking was downloaded 881,665 times in the United States. See here:

Over the last two years, Current has been downloaded 2,250,881 times in the United States.

Based on our analysis of Current’s reviews, the features that generate the most positive user sentiment are Notifications & Alerts, User Interface & UX, Stability, and Tutorial.

3. Dave - Banking for humans by Dave, Inc

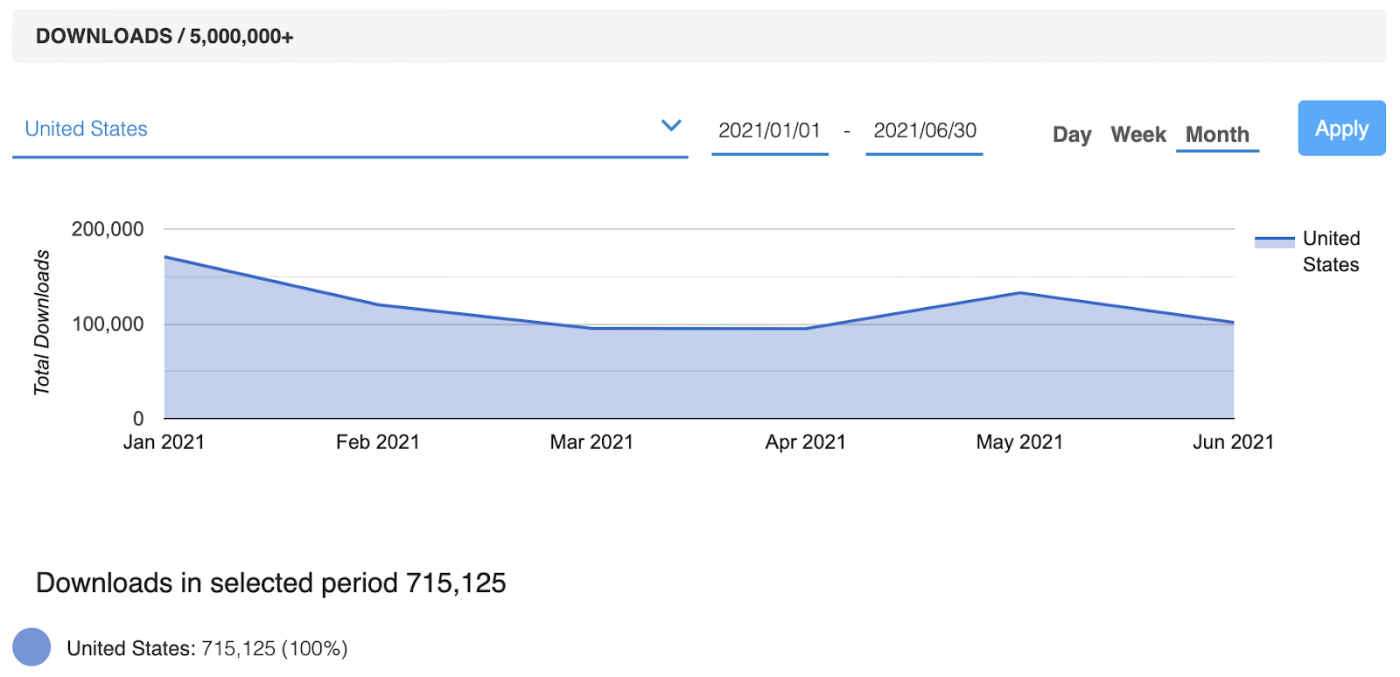

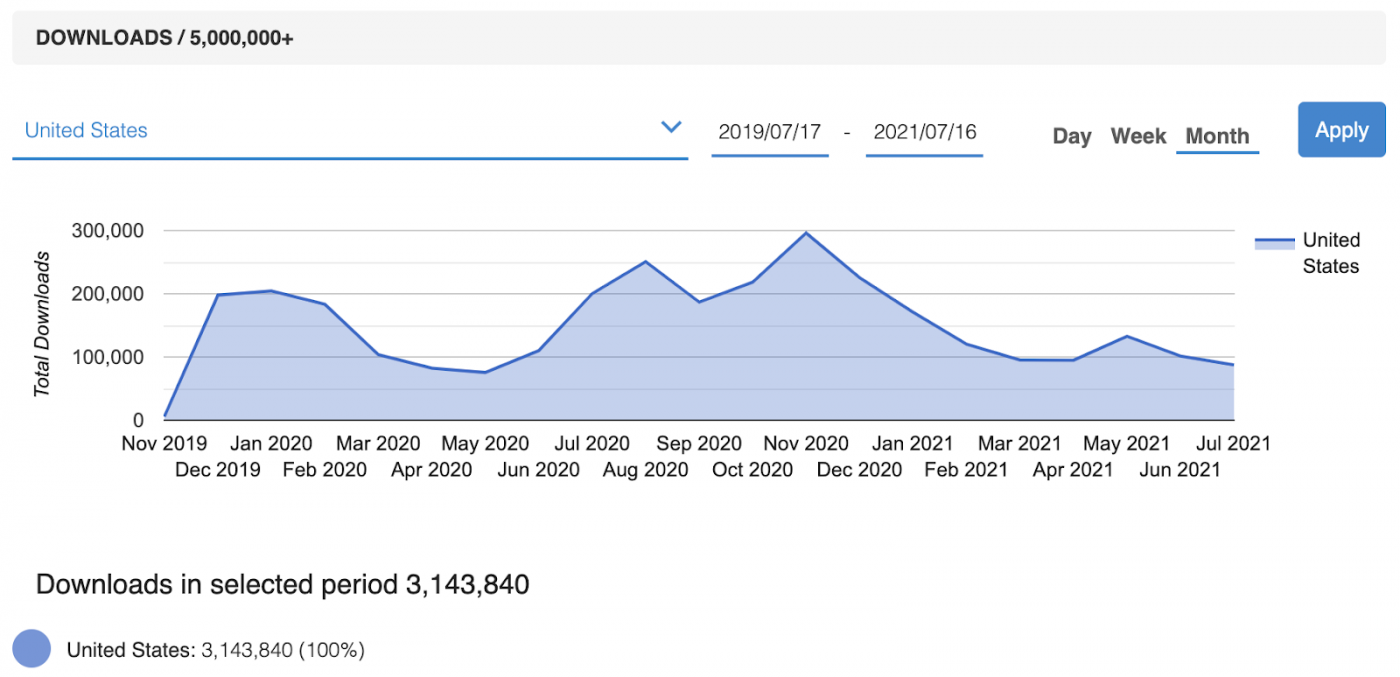

During the first six months of 2021, Dave - Banking for humans was downloaded 715,125 times in the United States. See here:

Over the last two years, Dave has been downloaded 3,143,840 times in the United States.

Based on our analysis of Dave’s reviews, the features that generate the most positive user sentiment are User Interface & UX, Notifications & Alerts, Signup & Login, and Tutorial.

4. Varo Bank: Mobile Banking by Varo Bank, N.A.

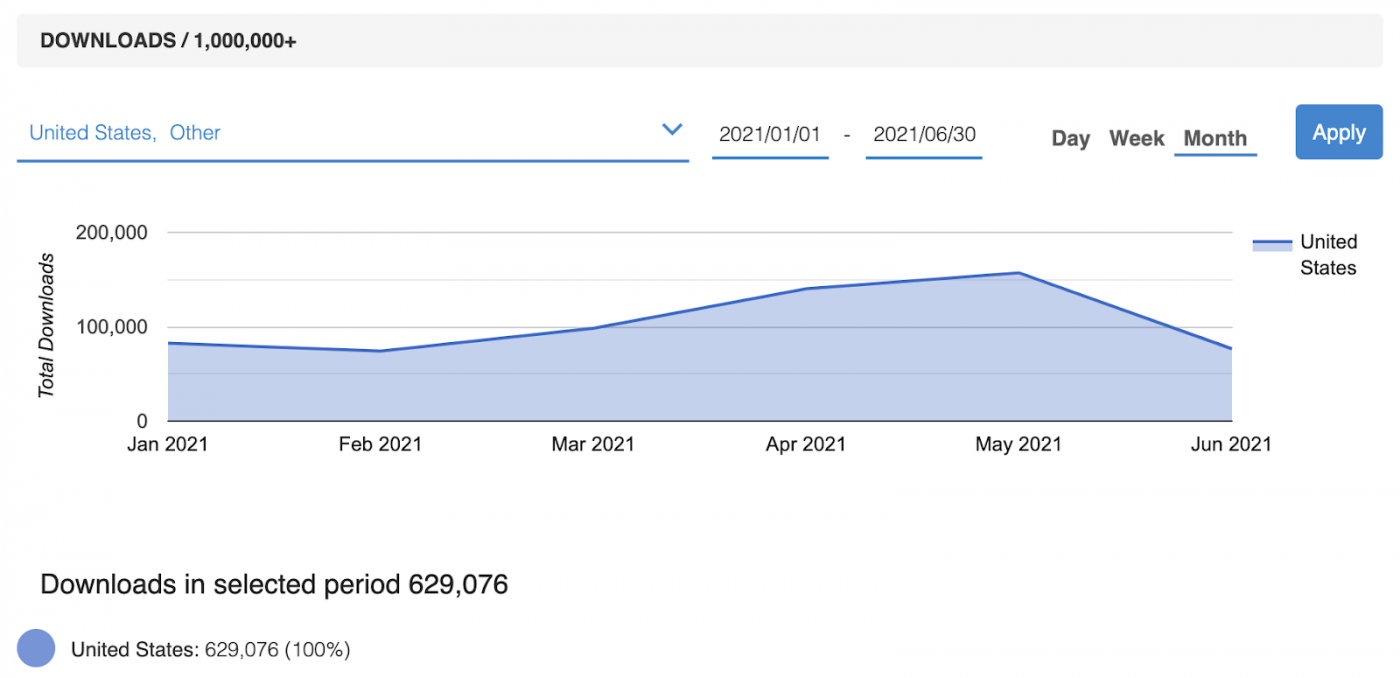

During the first six months of 2021, Varo Bank: Mobile Banking was downloaded 629,076 times in the United States. See here:

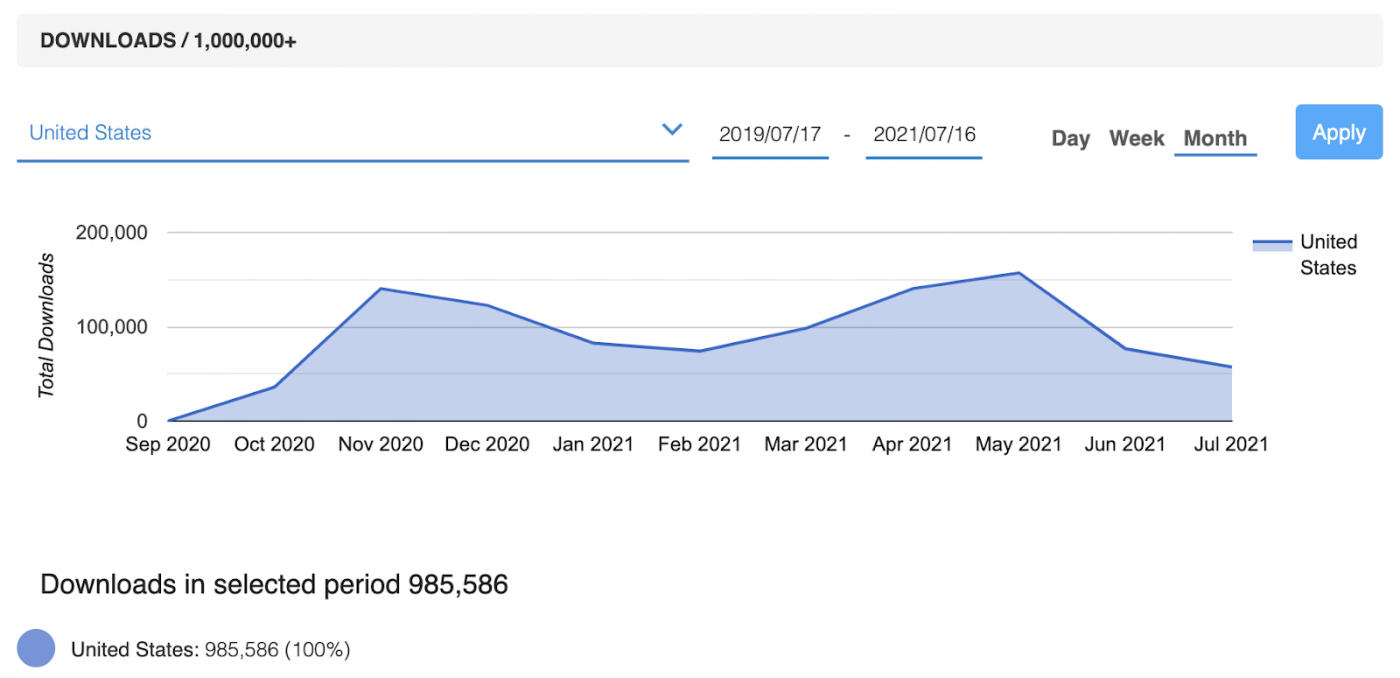

Over the last two years, Varo has been downloaded 985,586 times in the United States.

5. Albert: Budget. Save. Invest. by Albert Corp

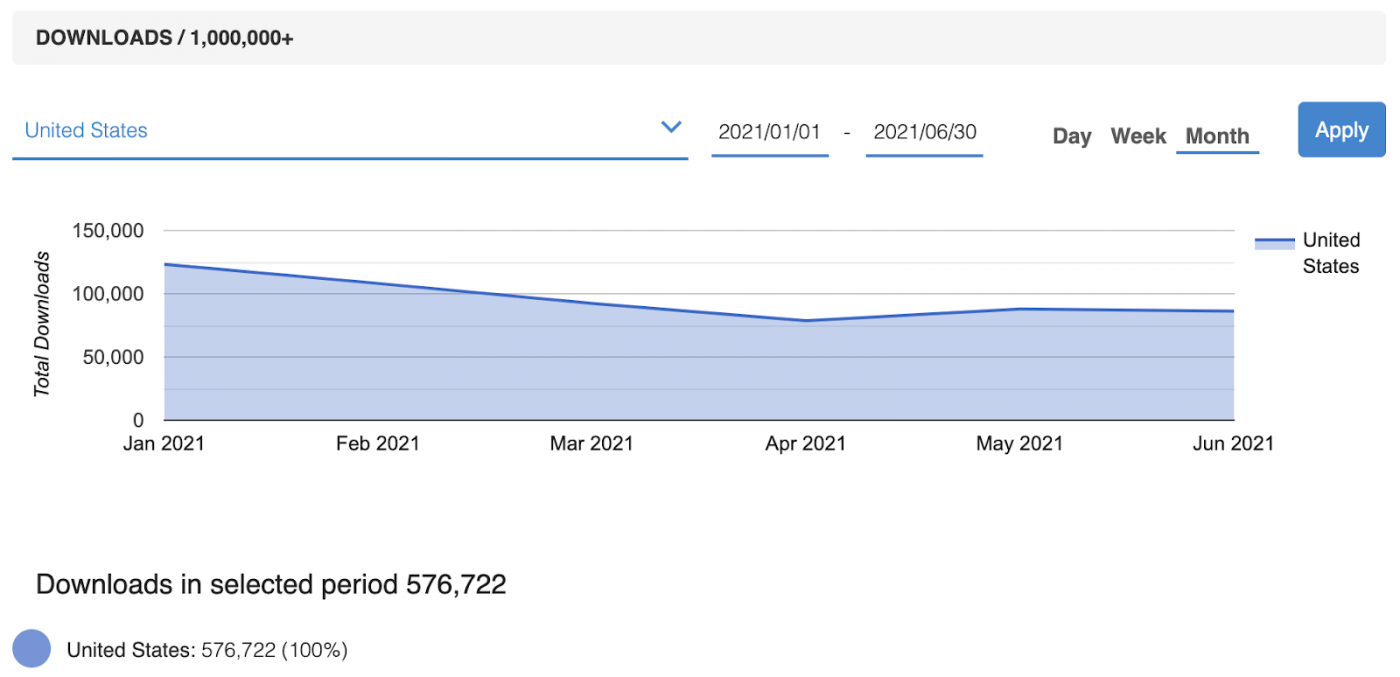

During the first six months of 2021, Albert: Budget. Save. Invest. was downloaded 576,722 times in the United States. See here:

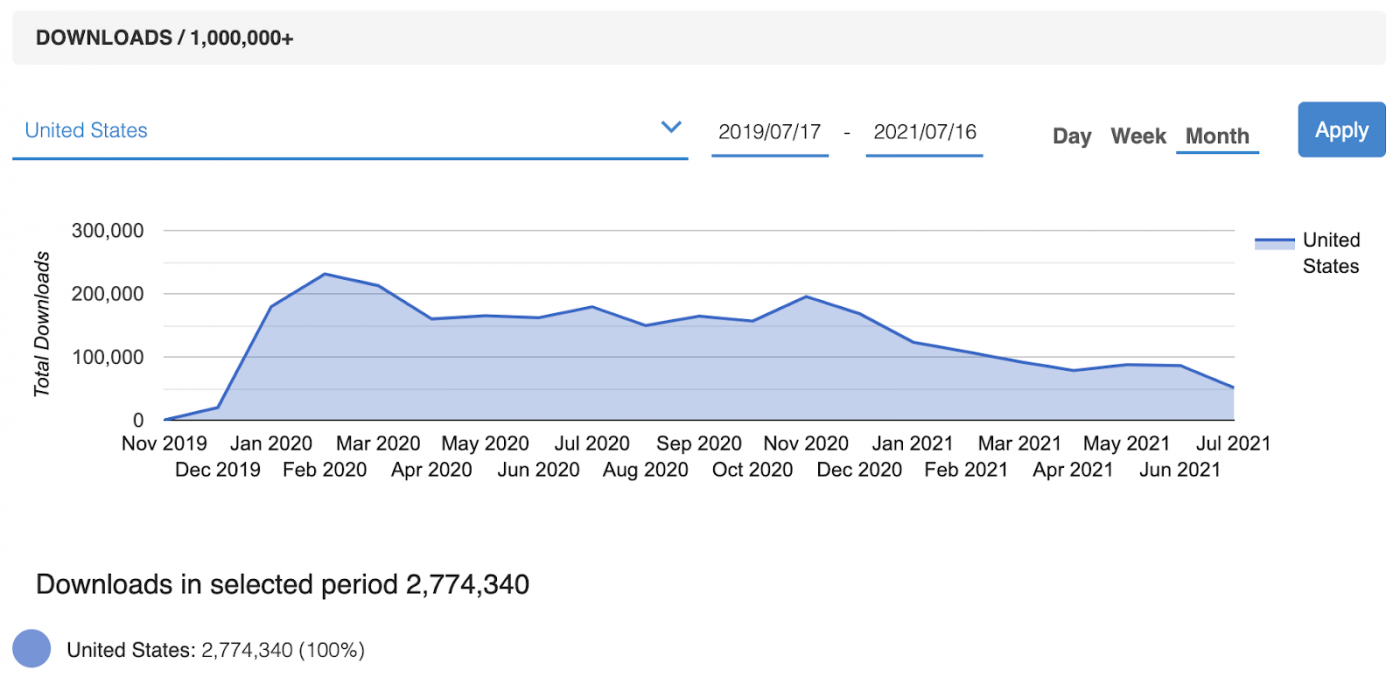

Over the last two years, Albert has been downloaded 2,774,340 times in the United States.

6. Step - Teen Banking by Step Mobile, Inc

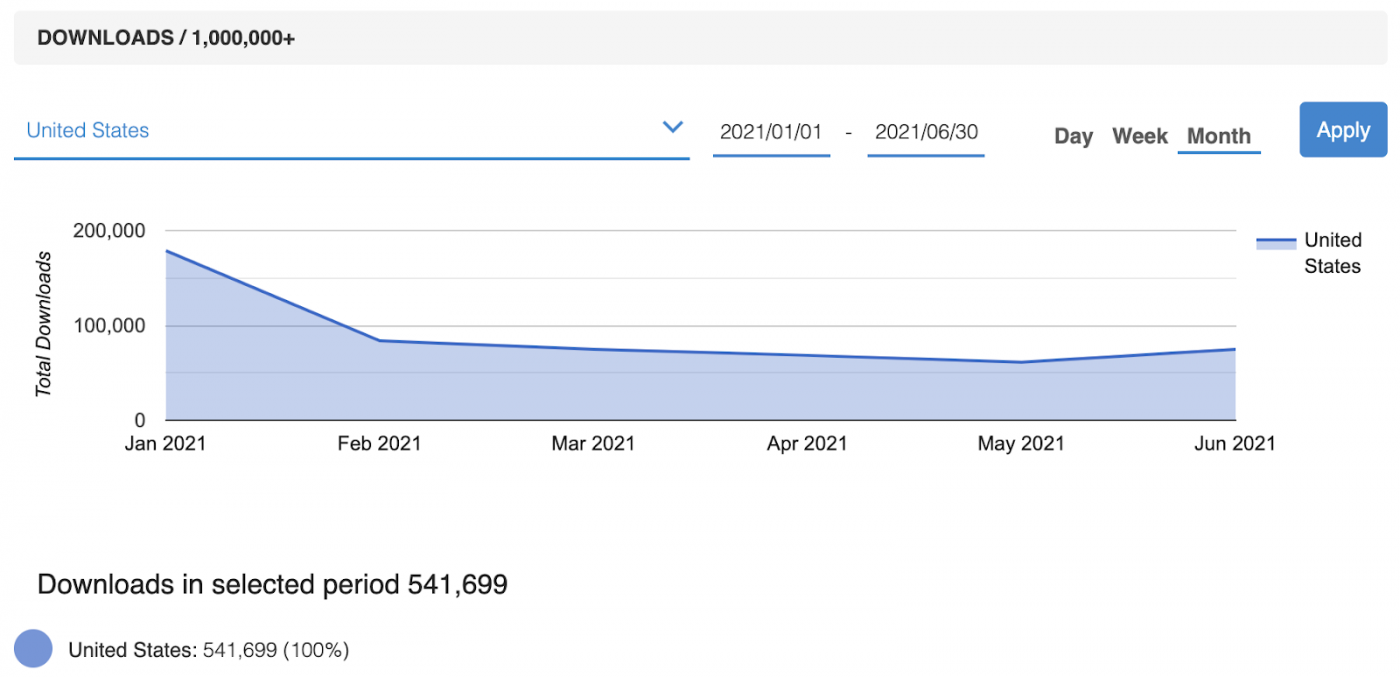

During the first six months of 2021, Step - Teen Banking was downloaded 541,699 times in the United States. See here:

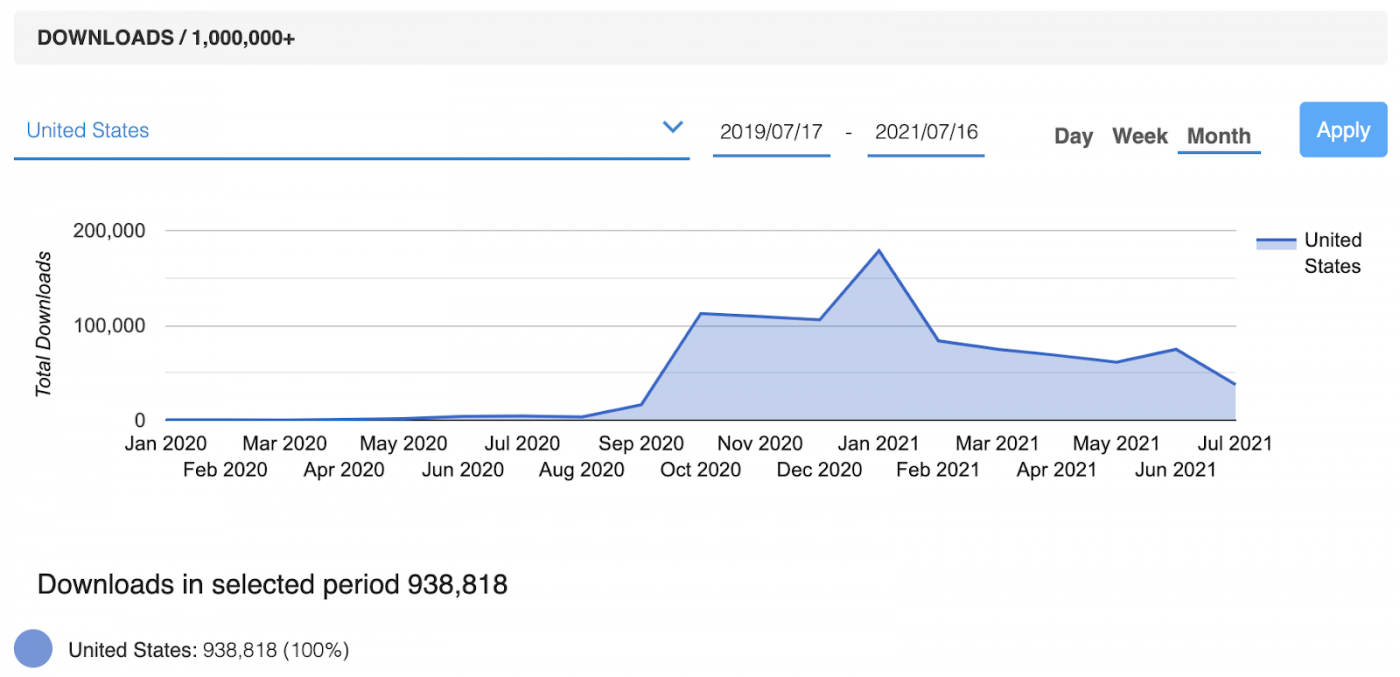

Over the last two years, Step has been downloaded 938,818 times in the United States.

7. MoneyLion: Mobile Banking App by MoneyLion Inc.

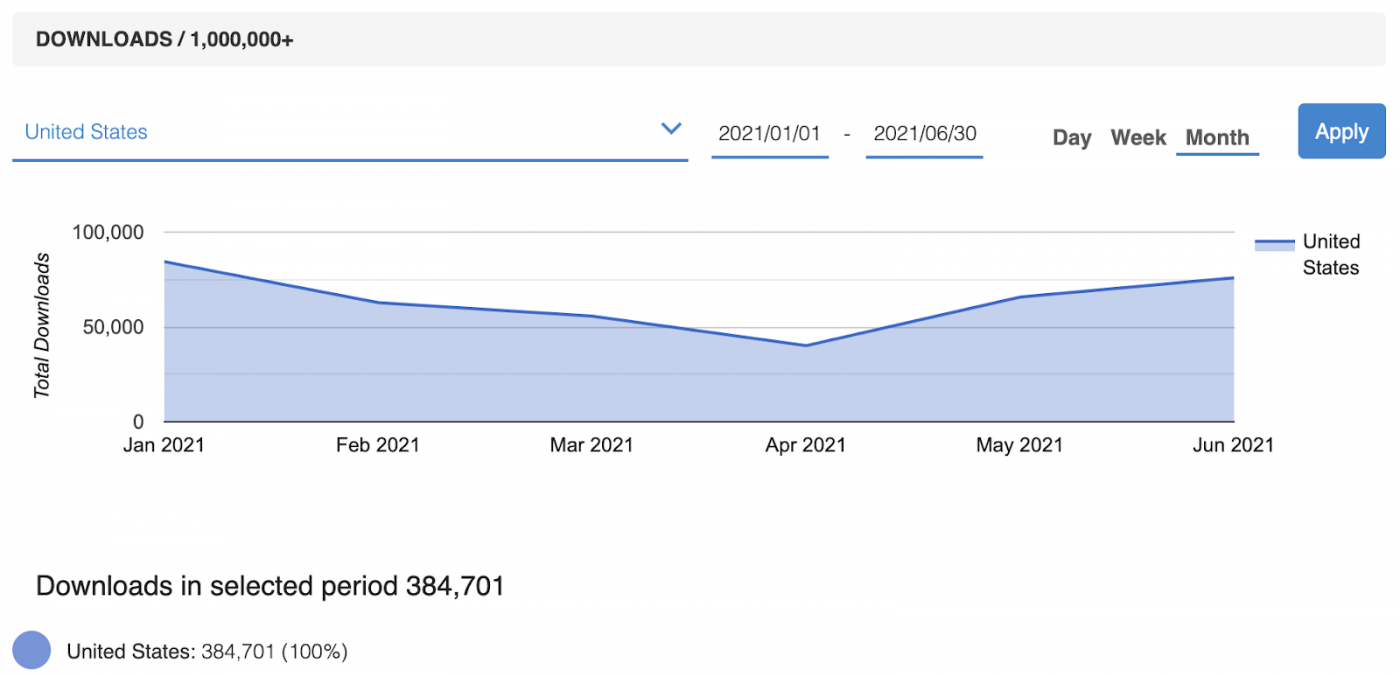

During the first six months of 2021, MoneyLion: Mobile Banking App was downloaded 384,701 times in the United States. See here:

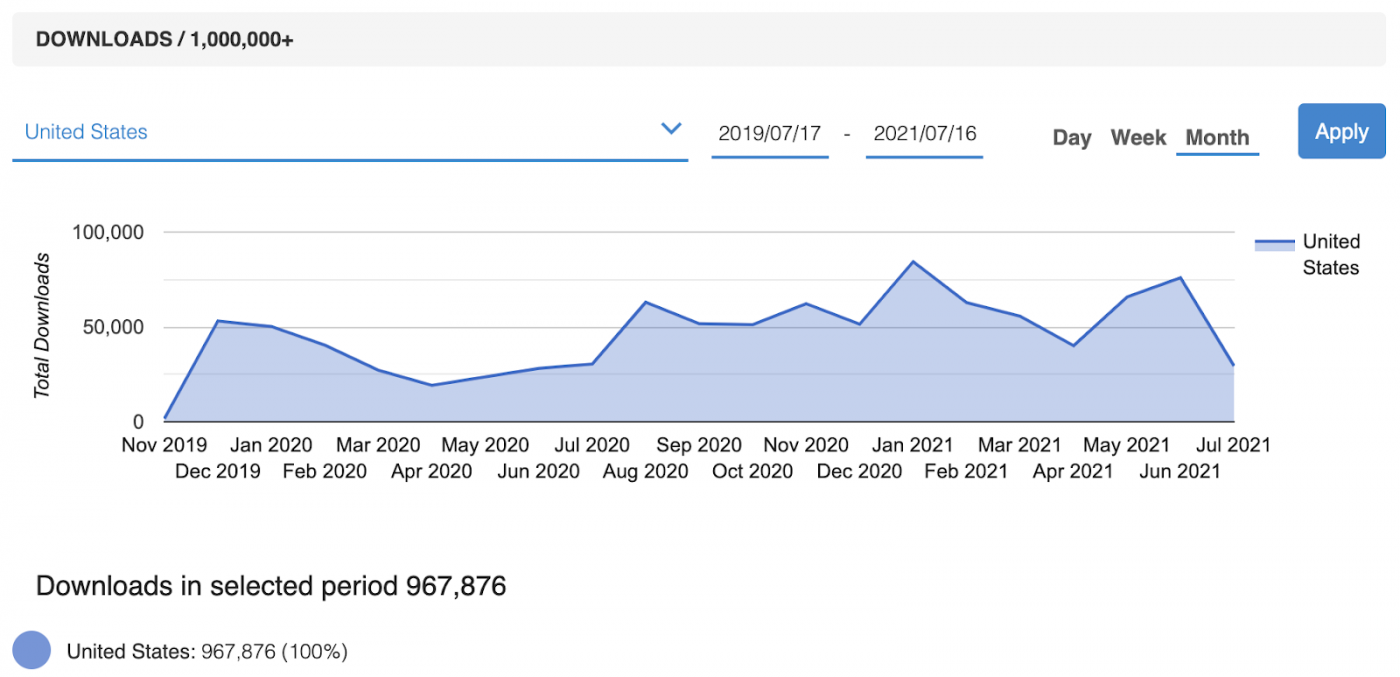

Over the last two years, MoneyLion has been downloaded 967,876 times in the United States.

How Neobanking Apps Compare to Traditional Banking Apps

The top seven most popular neobank apps in the United States combined for an average of 851,462 downloads over the past 6 months. Not bad, but how does that compare with the big leagues?

Let’s take a look at recent downloads (between January 1st, 2021 and June 30th, 2021) for some of the most popular traditional banking apps in the United States.

- Chase Mobile by JPMorgan Chase: 1,646,537 downloads

- Wells Fargo Mobile by Wells Fargo Mobile: 1,258,402 downloads

- Bank of America Mobile Banking by Bank of America: 1,215,911 downloads

- Citi Mobile® by Citibank N.A.: 572,108 downloads

All told, these four apps were downloaded on average 1,173,239.5 times over the past six months.

Conclusion

So, even the most popular neobanking apps lag behind the traditional powers on global app stores. That’s not much of a surprise — JPMorgan Chase, Bank of America, Wells Fargo, and Citigroup are powerhouses.

Indeed, these banks have enormous customer bases that have been banking with them for decades. And while their banking apps are being adopted in greater and greater numbers, they still have many clients that bank without them. This gives traditional banks quite a bit of room to grow.

Still, competition in the mobile banking space is heated. As demand for democratized and decentralized financial tools grows, it becomes increasingly likely that — at some point — we’ll see a true competitor emerge from the neobank pack. Right now, the smart money is on Chime – Mobile Banking.

Get Started With 42matters!

At 42matters, we provide app data, insights, and analytics via a host of useful APIs, file dumps, and the 42matters Explorer. This includes:

- Developer details

- Downloads

- Ratings, reviews, and top chart rankings

- Categories, genres, and IAB categories

- Technical insights, including SDKs, permissions, and app-ads.txt

- And more

The 42matters Explorer, which you can try free for 14 days, is an app market research tool that offers a comprehensive look at app trends and statistics. This includes data on both iOS and Android apps.

Moreover, our APIs facilitate programmatic access to app intelligence data from Google Play, the Apple App Store, Amazon Appstore, Tencent MyApp, and a host of connected TV app stores, including the Roku Channel Store, Apple TV tvOS App Store, Amazon Fire TV, Samsung Smart TV Apps, LG Content Store, and Vizio SmartCast Apps.

To learn more about 42matters, schedule a meeting with one of our app market experts. We'll walk you through everything.