Over the last 10-15 years, the rise of digital streaming and connected TV has caused a seismic realignment in the entertainment industry. Services like YouTube, Hulu, Netflix, Disney+, Roku, and others, have dramatically changed the way consumers interact with television.

Indeed, people are abandoning traditional cable providers in ever-growing numbers. According to the market research firm eMarketer, the US satellite and telecom TV industry is on track to lose over 6 million subscribers in 2020 alone. The firm also predicts that the total number of households to abandon linear TV will rise from 31.2 million in 2020 to 46.6 million in 2024.

While this phenomenon, known as “cord-cutting,” has led to increasingly poor returns for service providers, cable networks, and linear TV, it’s created opportunities elsewhere — for connected TVs, smart TVs, and smart streaming devices. For instance, according to the folks over at Innovid, 82% of households are expected to adopt connected TVs by 2023, with 44% cutting out cable completely.

Perhaps the biggest contributing factor to this is the fact that streaming services and connected TVs simply offer better products, giving consumers more control, on-demand access to their favorite content, and viewing options that are curated based on their viewing history and interests. This has made it possible for consumers to ditch expensive, thousand-channel cable packages that they don’t need and don’t want.

For companies like Roku, Amazon, and Apple, which provide connected TVs and smart TV streaming devices, cord-cutting has been a boon. By untethering popular channels and content from bulky cable packages, they’re able to offer customers lower costs, more options, and more personalized entertainment experiences.

Unsurprisingly, these shifts in the market also impact advertising. Take cable advertising for example. While advertising on TV remains lucrative, it no longer holds the pre-eminence it once enjoyed. In notable contrast, Innovid points out that in the span of one year alone the CTV ad impression share increased by 178 percent, overtaking desktop to account for approximately one-third of all digital impressions.

The first great blow to linear TV advertising was dealt by TiVo and other DVR devices, which enabled viewers to skip over ad breaks. Then came the streaming services, which facilitated more sophisticated targeting and audience engagement. Cord-cutting was merely the proverbial “cherry on top,” leading to stagnation in the ranks of cable and satellite subscribers, and better opportunities for advertisers in the connected TV space.

In this article, we’ll discuss the state of connected TV app stores in 2020 and beyond, addressing the following:

- What is a connected TV (CTV)?

- What is the difference between a connected TV and an OTT device?

- What is connected TV advertising?

- What is the connected TV device market share?

- Which connected TV app categories are most popular?

- Want to conduct your own research on connected TVs?

What is a connected TV (CTV)?

A connected TV (CTV) refers to any television capable of streaming video over the Internet or other mobile networks. TVs can be ‘connected’ either via built-in streaming and media platforms or external streaming devices. Typically, CTVs stream videos via apps like Netflix, Hulu, and HBO. CTV devices include:

- Smart TVs — Smart TVs have built-in internet capabilities and come with media platforms that enable users to navigate the digital streaming landscape. With smart TVs, no additional streaming devices are necessary.

- Connected Devices — Connected devices, sometimes referred to as over-the-top (OTT) devices, can be plugged directly into TVs, enabling them to serve up streaming apps and capabilities via the Internet. Think: Chromecast, Roku, Amazon Fire TV, and Apple TV.

- Gaming Consoles — Gaming consoles, such as the PlayStation 5 or Xbox Series X, can also act as connected devices since they offer built-in app stores that enable users to stream video content to their TVs.

What is the difference between a connected TV and an OTT device?

We touched on this above, but basically, an OTT (over-the-top) device is one you have to plug into your TV to facilitate digital streaming. A connected TV, meanwhile, is any TV capable of digital streaming — this could be enabled via internal technology (as with smart TVs) or the addition of an OTT device.

There are a variety of OTT devices that offer slightly different approaches to streaming. For instance, while Apple TV, Fire TV, and Roku come with sleek user interfaces and fully-loaded app stores, Google’s Chromecast cuts out the middleman, enabling users to cast chrome tabs directly from the computers onto their TVs.

That said, common to all OTT devices is the fact that, because they serve content via the Internet, users will not have to pay for cable to watch video content.

What is connected TV advertising?

The name says it all, really. Connected TV advertising refers to advertising on CTV platforms, enabling brands, production studios, and other companies to reach the audiences they lost through cord-cutting.

Advertising on CTVs offers:

- Superior targeting — By advertising on CTVs, businesses can benefit from rich demographic insights. This will help them place their ads in front of the right audiences, improving the return on investment for each ad.

- Easily measurable results — Programmatic platforms let businesses measure the results of their ad campaigns in real-time. They also provide a host of useful advertising metrics, such as video completion rate.

- Flourishing audiences — While the old-school cable and satellite industry is stagnating, the CTV and streaming markets are flourishing. And there’s no indication cord-cutting is a mere fad; by all indications it’s a trend that’s here to stay.

Of course, it’s still pretty hard to beat a primetime ad spot during the Super Bowl. Nevertheless, traditional TV commercials don’t reach the audiences they used to and, according to the media investment company GroupM, global TV ad spend is expected to drop 17.6% in 2020.

While declining TV ad spend may well be attributable to the global pandemic, coronavirus has been far less adept at curbing growth in connected TV advertising. As the Interactive Advertising Bureau (IAB) notes in their study “IAB U.S. 2020 Digital Video Advertising Spend Report: Putting COVID in Context,” connected TV advertising spend grew from an average of $11.7 million per participating client in 2018 to $14.8 million in 2019. IAB estimates average advertising spend on connected TV platforms will reach $16.0 million this year — in spite of the coronavirus pandemic.

Clever advertisers will also note that apps available on connected TV app stores present additional advertising opportunities. Indeed, by working with ad networks, businesses are able to place highly targeted ads in the most popular apps. And, since most ad networks leverage connected TV app data to inform ad placement, they’re able to ensure that all brand requirements are met and all demographics are accounted for.

What is the connected TV market share?

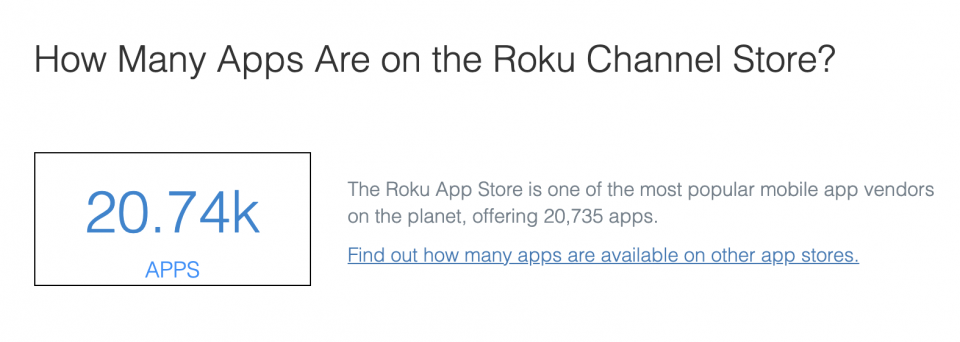

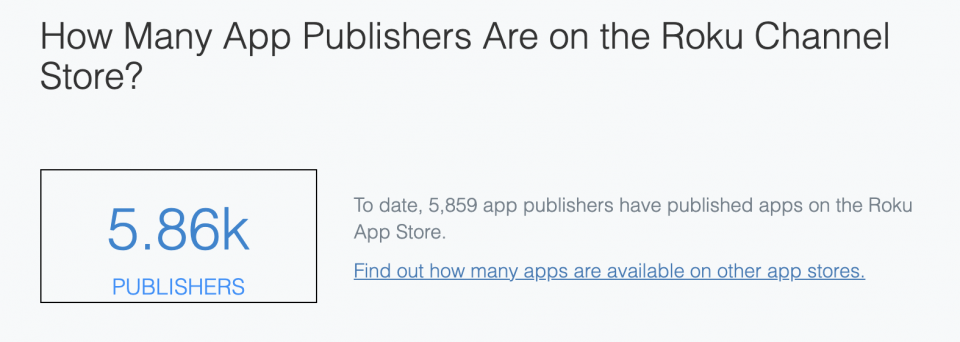

Roku Channel Store

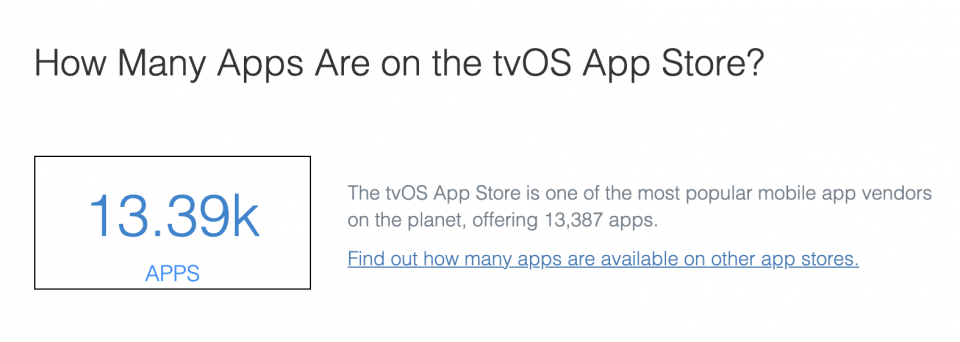

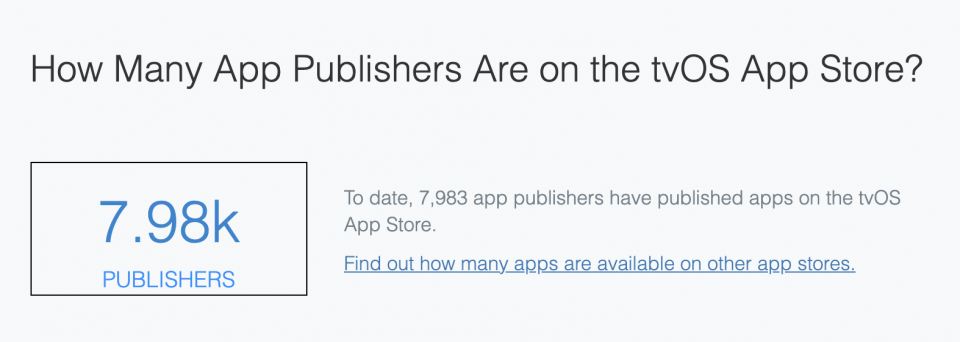

Apple TV tvOS App Store

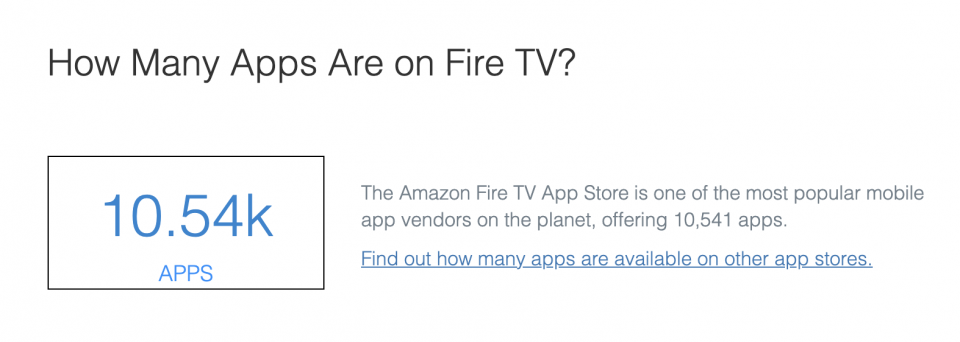

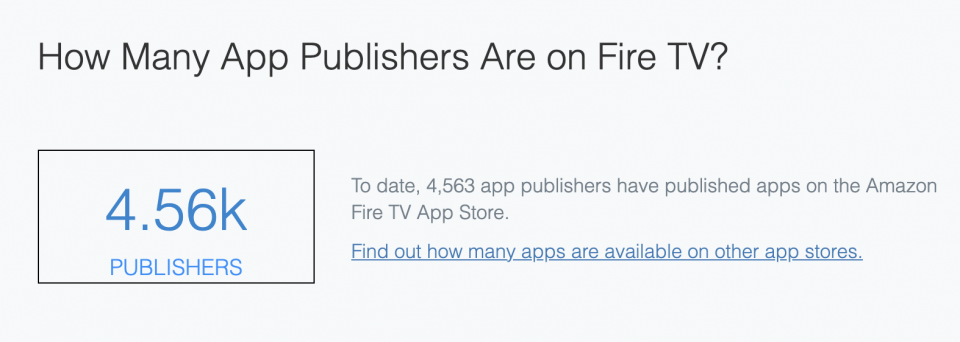

Amazon Fire TV

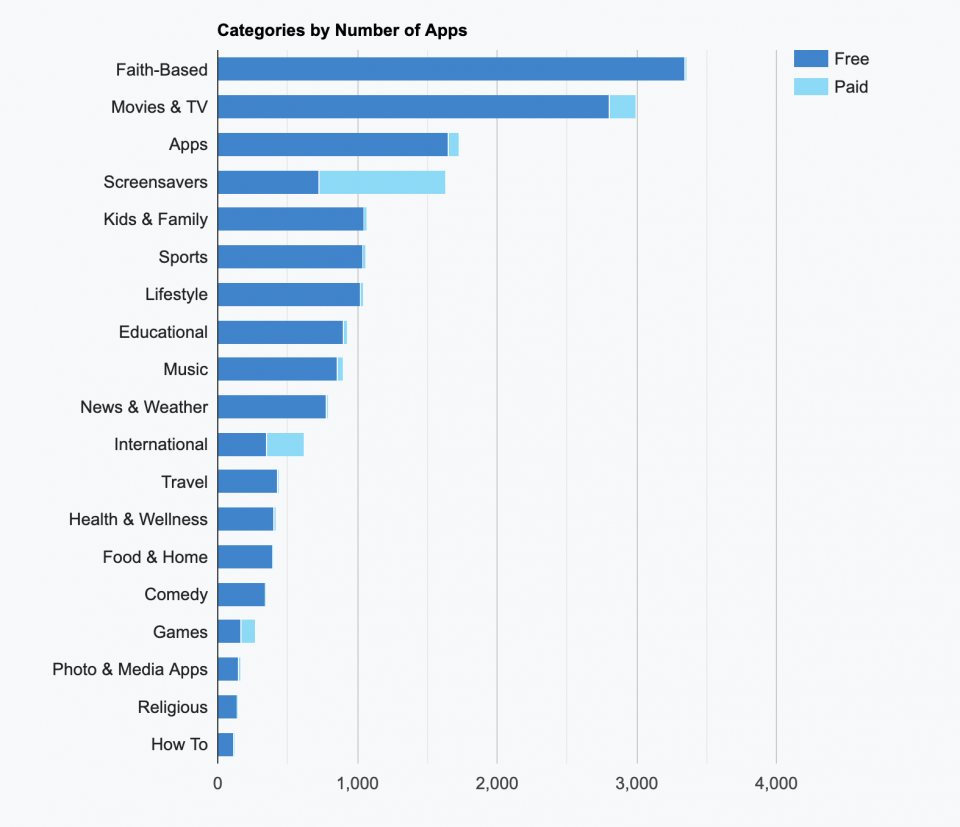

Which connected TV app categories are most popular?

Roku Channel Store

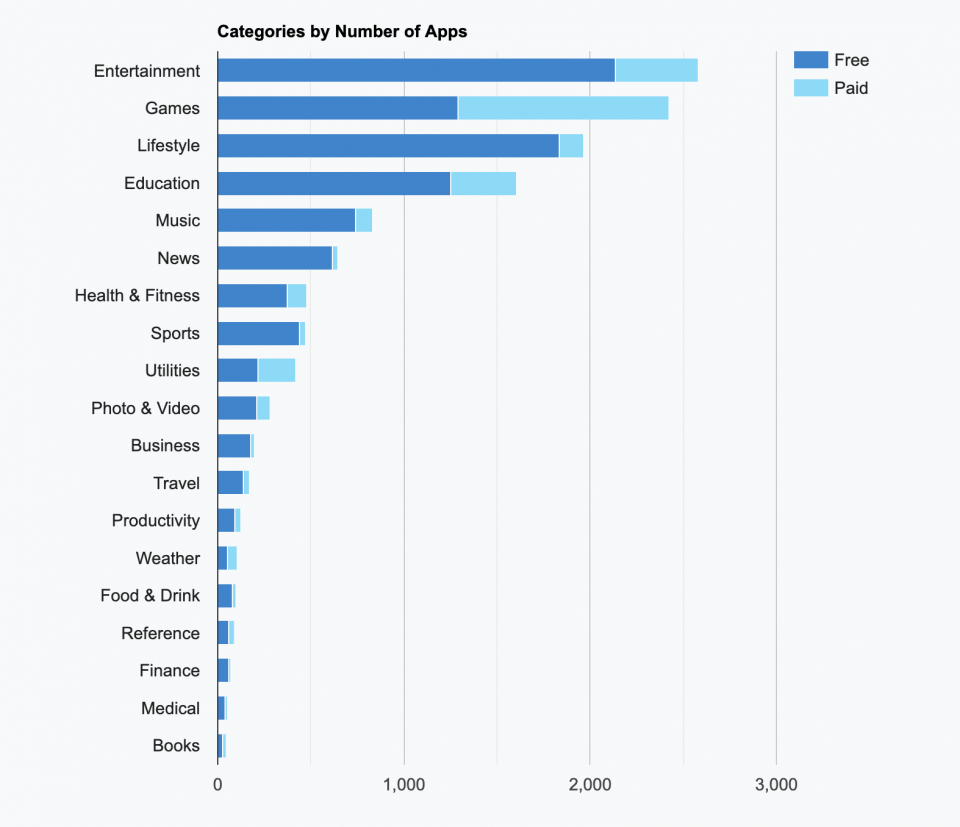

Apple TV tvOS App Store

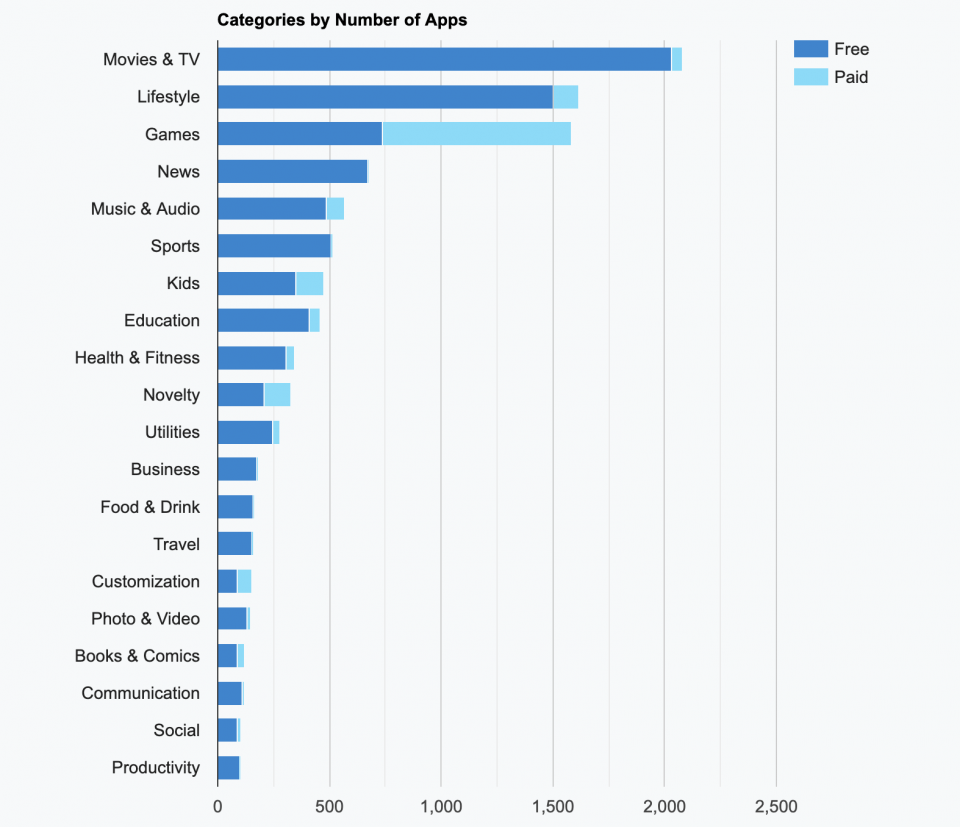

Amazon Fire TV

Want to conduct your own research on connected TVs?

42matters has all your CTV app and app store requirements covered! We provide insight into the Apple TV tvOS App Store, Amazon Fire TV, and Roku Channel Store via a host of datasets and free tools. To get started, we recommend checking out our file dumps for connected TV apps. We offer sample data dumps, which are updated daily. Click the links below to download the sample data dumps:

Beyond CTV app stores, we track several thousand metrics for 15+ million apps — including publisher details, app metadata, technical insights, and more — across Google Play, the Apple App Store, Amazon Appstore, and Tencent Appstore.

To learn how 42matters can help you stay informed on the state of the CTV landscape, schedule a free demo with one of our experts.