The 42matters App Watchlist is a powerful tool for mobile app market analysis, offering insight into 16.3+ million published and unpublished apps available on Google Play and the Apple App Store. It’s particularly well-suited for researching and monitoring your target markets since it enables users to focus their efforts on leaders in those areas.

In this article, we briefly introduce the App Watchlist. Then we demonstrate how it can be used for mobile app market research and analysis.

Here’s what we cover in this blog post (click the links below to jump to the corresponding section):

- What Is the 42matters App Watchlist?

- Analyzing the App Market and Monitoring Your Market Niche With the App Watchlist

- Using the 42matters Explorer to Identify Apps Operating In Your Market

- Analyze Trending Apps

- Evaluate New Competitors When They Enter the Market

- Keep an Eye on Apps With Breakout Potential

What Is the 42matters App Watchlist?

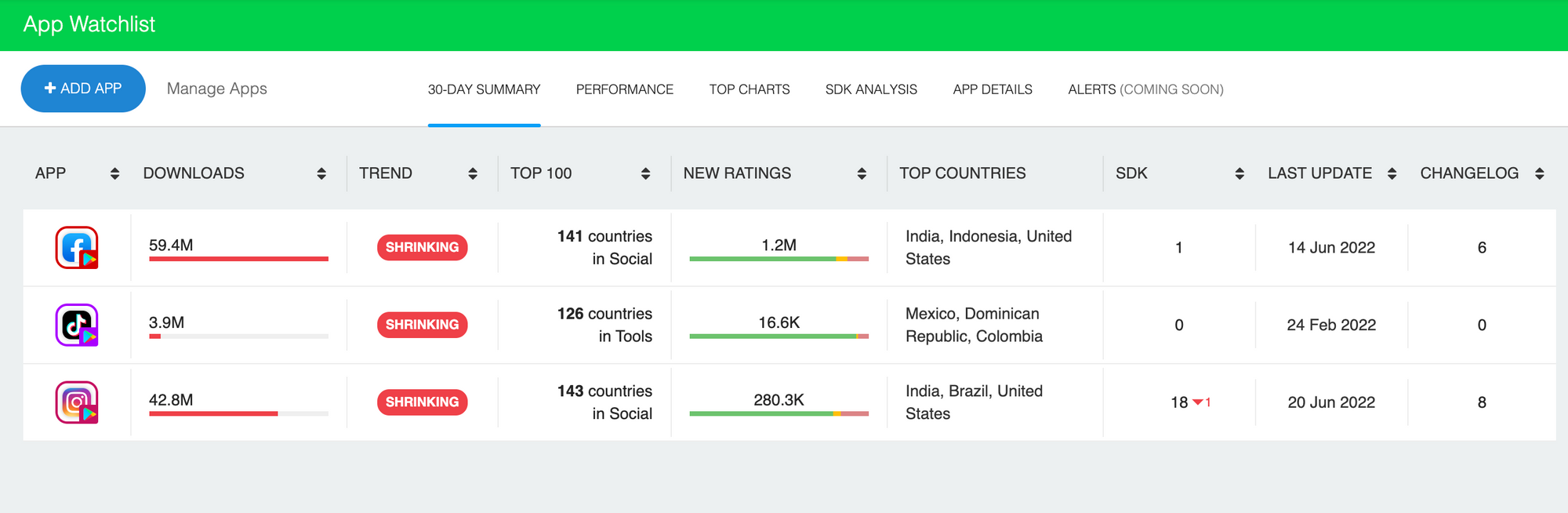

The 42matters App Watchlist is an app benchmarking tool that enables users to pick any iOS or Android apps available on the Apple App Store or Google Play to monitor.

You can use it to track performance metrics, SDK stacks, technical specs, app details, and metadata. More specifically, you’ll be able to track…

- Downloads (including country-specific and regional downloads)

- Integrated SDKs (with install / uninstall dates)

- Ratings and Global Top Chart Rankings

- App Update Timelines / Changelogs (including release notes, feature updates, and new versions)

- Categories, Genres, and IAB Categories

- App Details and Metadata (including things like Title, App Description, Developer Name, etc.)

Analyzing the App Market and Monitoring Your Market Niche With the App Watchlist

App publishers can use the App Watchlist to keep an eye on their industry. They can follow market leaders, zoom in on specific categories, refine their focus to apps operating in specific markets, benchmark near-peer competitors, monitor apps that could become competitive threats — you name it!

For now, however, we will focus on three particular use cases. Namely, how app developers can use the App Watchlist to…

- Analyze Trending Apps

- Evaluate New Competitors When They Enter the Market

- Keep an Eye on Apps With Breakout Potential

But first, we should cover how users can identify which apps to track via the App Watchlist.

Using the 42matters Explorer to Identify Apps Operating In Your Market

Now, if you already know which apps and app publishers comprise your market niche, feel free to skip ahead to the next section. However, if you don’t know, or if you lack a thorough understanding, you might want to stick around for a moment.

The 42matters Explorer is a visual app market research tool that provides insight into all published and unpublished apps on Google Play and the App Store. It offers performance metrics (downloads, monthly active users, ratings, rankings, etc.), tech insights (integrated SDKs, required permissions), monetization information, localization practices, and much, much more.

However, relevant to the topic at hand, you can use the Explorer’s filtering capabilities to identify competitors across the app market. To demonstrate, let’s focus on some of the most useful filters…

- Android Category, iOS Genre, and IAB Category

- Recent Downloads and Monthly Active Users

- Release Date

Android Category, iOS Genre, and IAB Category

Android categories and iOS genres are broad. They’re great for helping end users find apps relevant to their interests or needs, but there’s generally too much diversity within each category for them to be of much use to publishers who want to identify competitive threats.

This is where the IAB’s content taxonomy comes in. IAB categories offer more precision than traditional app store categories. For example, while Android offers a generic ‘Travel & Local’ category, IAB offers a ‘Travel’ category with two unique subcategories (‘Travel Locations’ and ‘Travel Type’) comprised of numerous sub-subcategories like ‘Hotels and Motels,’ ‘Rail Travel,’ ‘Air Travel,’ region specific travel (i.e. ‘Africa Travel,’ ‘Polar Travel,’ etc.), and more. In other words, IAB categories are extremely precise. And this precision makes the IAB’s content taxonomy a powerful tool for identifying direct competitors.

As such, you can use the Explorer to identify not only apps within your category but also apps that offer comparable services. You can apply the IAB category filter alone or in tandem with the other category and genre filters. For example, here are all Android apps that fall into both the ‘Entertainment’ Android category and the ‘Air Travel’ subcategory of the ‘Travel’ IAB category:

Recent Downloads and Monthly Active Users

You can also use the Explorer to identify competitors based on performance trends. For instance, with the ‘Monthly Downloads’ filter, you can find all competitor apps that have been downloaded a certain number of times over the last 30-days. Likewise, the ‘Monthly Active Users (MAU)’ filter can be used to filter out those that don’t match a certain threshold for MAUs.

From here, you can investigate each one individually to see whether they are trending up, trending down, or remaining stable over time. Like so:

Release Date

The last technique we’ll discuss here is how to find competitors that have just entered the market. The Explorer comes with a ‘Released Date’ filter that enables you to identify apps released within the last 30 days, 7 days, or 24 hours. You can also enter a custom date range if you’re interested in a specific time period:

By using this filter in tandem with the Explorer’s other filters (the IAB category filter, for instance), you’ll be able to identify when new competitors enter the market or when existing competitors release new apps. For example, below you’ll find a list of all 38 ‘Air Travel’ (an IAB category) apps released between January 1st, 2022 and June 17th, 2022.

Analyze Trending Apps

Okay, now that we’ve gone over how to use the Explorer to identify which apps to track with the App Watchlist, let’s look at how the Watchlist can be used to gain valuable market insights.

Let’s say you’re researching trending apps in the air travel industry and plan to use the App Watchlist to track the performance of trendy apps over time. To begin, you use the Explorer to build a list of all apps that match your criteria. You use it to identify all ‘Air Travel’ apps that have been updated in the last year and which have been downloaded at least 1,000 times in the last 30 days.

Then, you add the five most downloaded ‘Air Travel’ apps over the last 30 days to your app watchlist. In this case MakeMyTrip, Traveloka, Flightradar24, Ryanair, and Flight Booking & Hotel Booking (Goibibo).

Using the Watchlist to monitor these apps, you notice that Flight Booking & Hotel Booking (Goibibo) experienced a substantial uptick in downloads beginning May 30th, 2022 and culminating on June 2nd.

To figure out what initiated this spike, you look at the changelogs for Flight Booking & Hotel Booking (Goibibo) from the relevant time period.

It turns out, on May 29th, 2022, Goibibo changed the app name to something more ASO-friendly: Flight Booking & Hotel Booking. The next day, downloads for the app exploded.

Evaluate New Competitors When They Enter the Market

Next, let’s say you work for an online travel booking company that focuses on rail / train travel in India. While you’re already monitoring your biggest competitors, you do some research on the Explorer and discover that 23 new companies have launched apps similar to yours since the beginning of the year. Check it out, below you’ll find all ‘Rail Travel’ apps released in India since January 1st, 2022.

What’s more, you see that some of these apps have already generated hundreds of thousands of downloads. So, you decide to add these to your Watchlist.

Three of these apps, in particular, have separated themselves. In this case, redRail recently generated over 565,000 downloads in just 30 days, Rail Sheba (BD Railway) was downloaded 58,000+ times, and Rail Sheba (Buy Train Ticket) was downloaded 45,000+ times. So, you do some digging to figure out why.

The first thing you notice is that the Rail Sheba apps are gaining traction in regions that aren’t in your app’s footprint, like Bangladesh, Saudi Arabia, Singapore, and the United States.

After reviewing the apps’ SDKs and changelogs, you determine that they don’t have any inherent technical advantages. You, therefore, feel confident that by making your app available in the same countries, you can replicate their success and bolster your user base.

In essence, you’ve determined that these apps may have identified underserved markets, and you are resolved to tap into them. You instruct your product team to translate and localize your app.

Keep an Eye on Apps With Breakout Potential

Sometimes apps make a big splash before they’ve even launched. This recently happened in the BNPL space when Apple announced Apple Pay Later at their Worldwide Developers Conference, immediately putting companies like Klarna and Afterpay on notice. In such circumstances, it’s important to keep a close eye on apps with breakout potential to see whether they have any clear advantage over your offering that might pull customers away.

So, let’s look at an example. Imagine that you work for a major coffee chain (think Starbucks, Costa Coffee, Dunkin’, Tim Hortons, etc.) and you’re in charge of managing the loyalty and rewards aspect of the company’s mobile app. Let’s say you’ve just learned that your biggest competitor announced a new mobile app with a similar rewards offering.

You can use the App Watchlist to keep an eye on their app immediately after they launch it and monitor its success over time. You can track which SDKs they integrate, which permissions they require, what technical problems they’re having and addressing, etc. This will enable you to determine what tools they’re using to power their loyalty program as well as any changes they make to it.

Moreover, you can monitor their performance and discover the impact of technical updates on things like ratings, rankings, and downloads.

You’ll also be able to determine which countries and regions are driving their app’s success, whether users are happy with the product, and whether it appears to be catching on.

These insights will enable you to analyze your competitor’s go-to-market strategy for their new mobile app and rewards program, and weigh those decisions against near real-time results. You can then take your learnings and apply them to your own business by using them to inform your roadmap or as a performance benchmark.