Now, this may come as a shock, but we here at 42matters are quite interested in the financial sector. We know; a Swiss company interested in banking and finance — quelle surprise! But we actually approach the industry from a different angle than most Swiss companies. You see, we’re focused on the mobile app economy. So, in this article, we’ll discuss how you can use app data from 42matters to conduct market research on the financial app sector.

But first, some statistics:

- There are more than three billion smartphone users across the globe, according to Statista.

- More than 50% of all web traffic now comes from mobile devices, up from a mere 31% in 2015 — also according to Statista.

- There are 94,620 “Finance” apps on Google Play out of 3,344,003 total apps. (As of June 19, 2020)

- There are 74,885 “Finance” apps on the Apple App Store, out of 1,791,581 total apps. (As of June 19, 2020)

Much like the rest of the world, businesses concerned with matters of money are increasingly going mobile. Practically every major bank in the world has an online banking app; and it seems like every other week the mobile economy begets a new ‘all-in-one’ money management app, or a digital wallet with a Silicon Valley twist, or a commission-free investing app with ironic copy, a minimalist logo, and a comely two-tone color palette.

And go figure. Who wants to spend their lunch break running to the bank? Or arguing with colleagues about how to split the check? Indeed, the reason financial apps like Venmo, Mint, and Cash App are so successful is that they make life easier. Consider for a moment the coronavirus pandemic. Many small businesses and restaurants spent lockdown prepping for re-opening by making their service as contactless as possible, replacing physical menus with QR codes and eschewing cash for contactless alternatives. Under these circumstances, it’s easy to see the appeal of app-based money management.

So, on the one hand, you have companies like UK-based Revolut — whose apps have collectively surpassed five million downloads across the UK, Ireland, and continental Europe — carving out sizable pieces of the mobile app market by building cutting edge financial management apps.

On the other hand, more conservative financial institutions are playing catch-up as the possibility of reaching a younger, mobile-first generation of consumers becomes increasingly remote. (And, just between us, these folks have a tough row to hoe.)

That said, if you’re looking to break into the mobile economy’s financial app sector, don’t fret! We at 42matters are by no means defeatists. Indeed, our tools can help traditional and upstart financial services businesses access the increasingly competitive financial app market by offering a near real-time view into the latest trends on both Google Play and the Apple App Store.

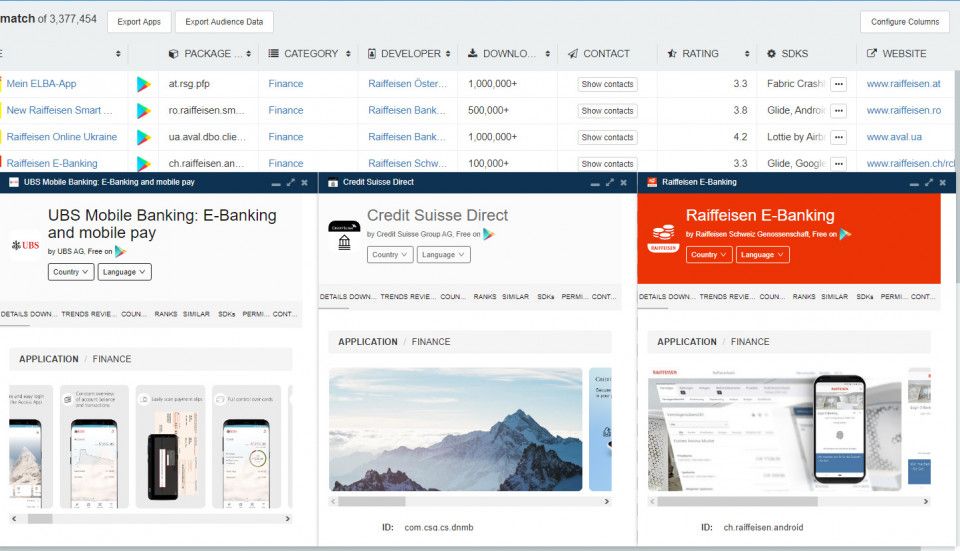

To demonstrate how the 42matters Explorer can be leveraged to conduct market research with a focus on financial apps, we’ve examined 12 critical factors pertaining to the UBS, Credit Suisse, and Swiss Raiffeisen Bank apps. Unless otherwise stated, all data is from Google Play.

Let’s begin!

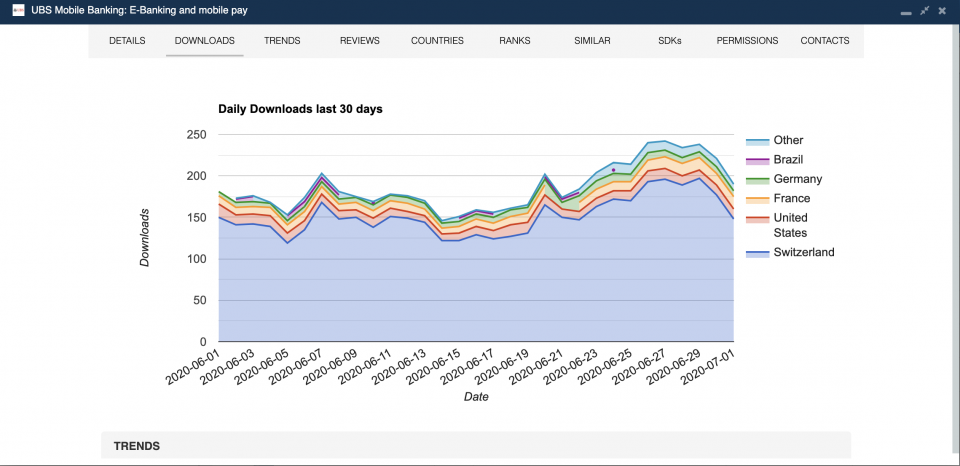

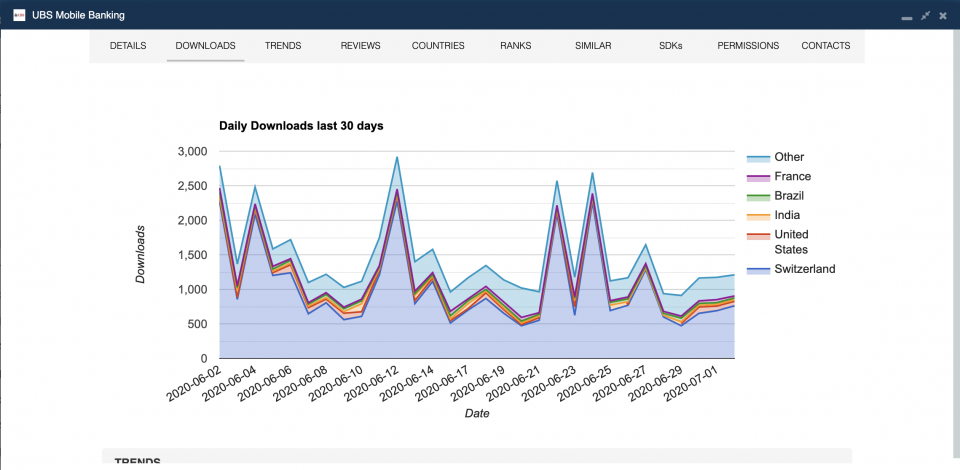

1. Number of Downloads

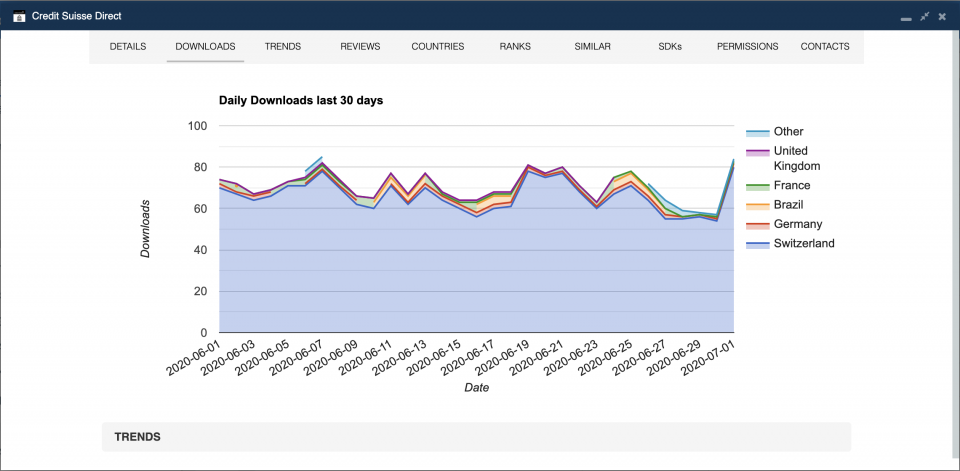

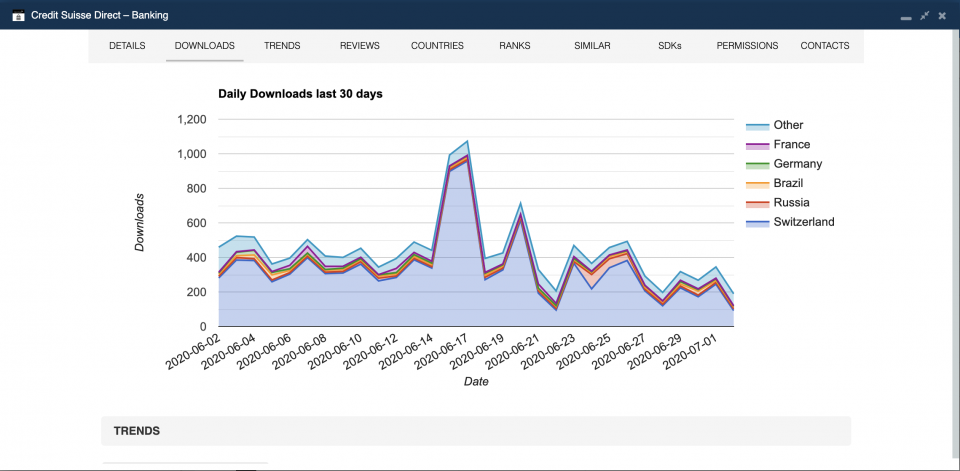

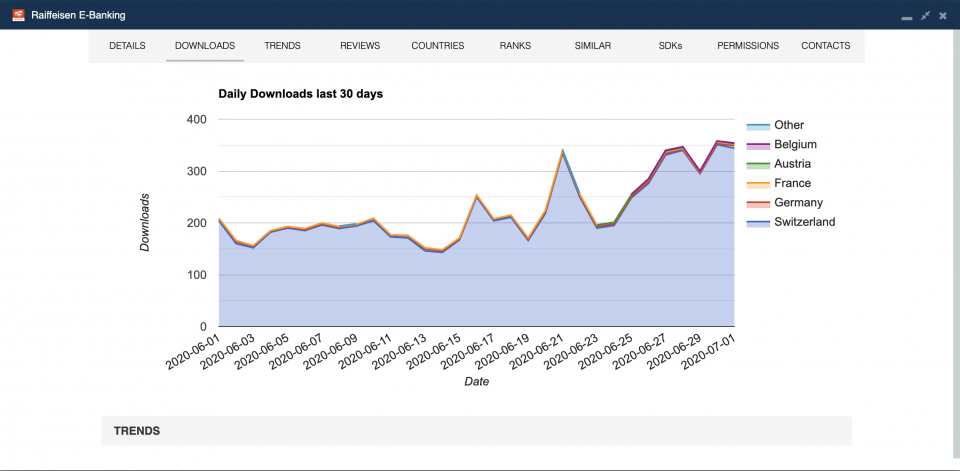

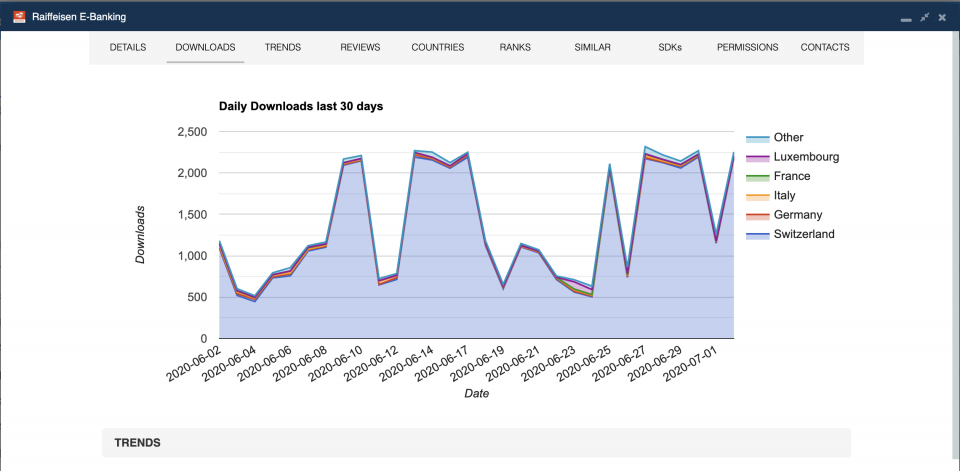

Unsurprisingly, downloads are an essential KPI for gauging the success of a financial app. The 42matters Explorer provides total download estimates and both monthly and daily download counts. Our APIs provide similar capabilities. For instance, you can use them to track annual downloads and see whether an app is trending up or down.

Here is a side-by-side comparison of daily Android and iOS downloads for the UBS, Credit Suisse, and Swiss Raiffeisen Bank apps over a 30-day period:

- UBS (500,000+ total downloads)

- Credit Suisse (100,000+ total downloads)

- Swiss Raiffeisen Bank (100,000+ total downloads)

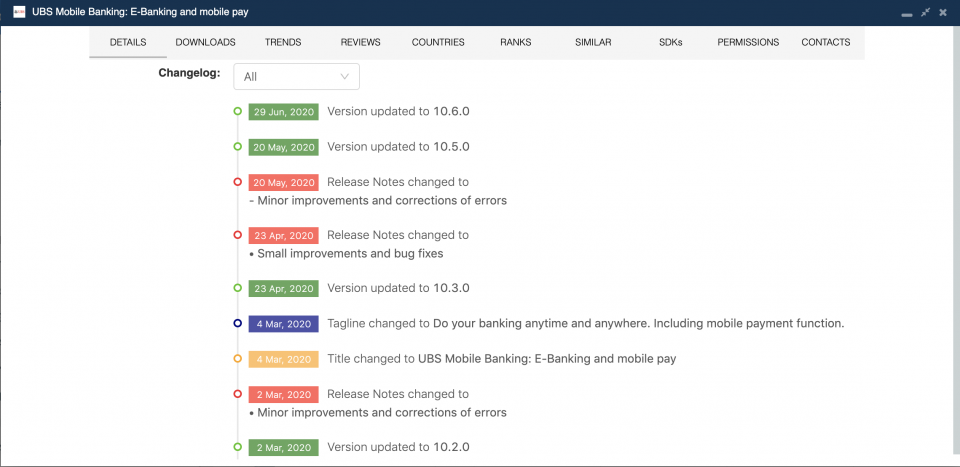

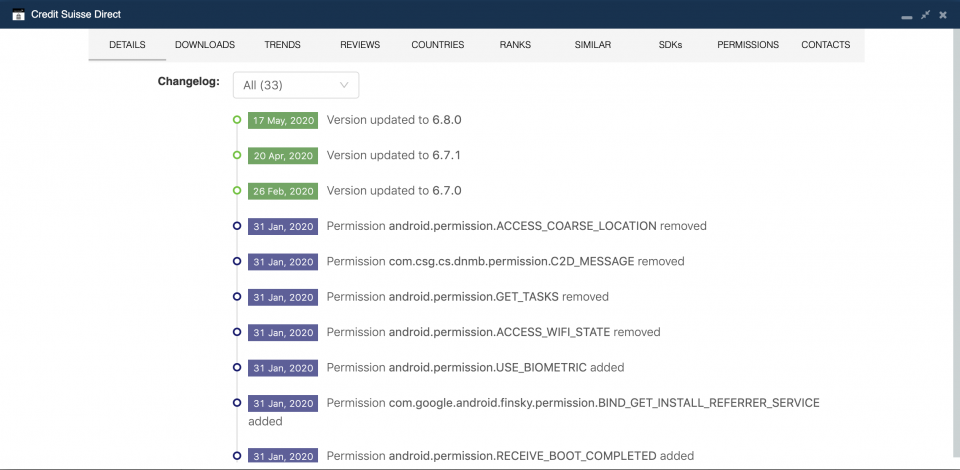

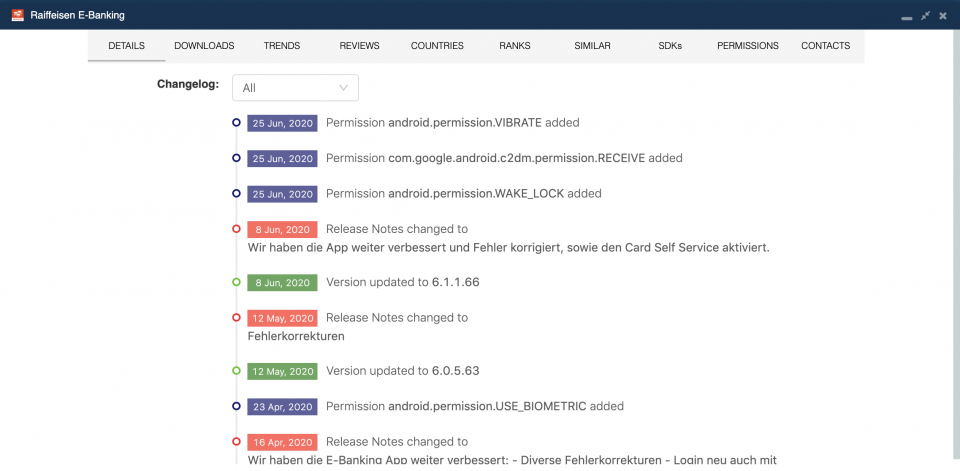

2. Compare Changelogs

Changelogs provide valuable competitor insights. They enable you to see how frequently your rivals are updating their products, whether they have a scheduled release cycle, and what sort of updates they’re making.

This is handy for a number of reasons. First, you can use update frequency to estimate how many developers your competitors employ and what sort of project management structure they’re leveraging. Moreover, changelogs enable you to determine where your competitors appear to be struggling. Are they perpetually tinkering with their UI? How about rejiggering their security or log-in protocols? Smart marketers can make hay with these insights.

Here’s what UBS, Credit Suisse, and Swiss Raiffeisen Bank have been up to:

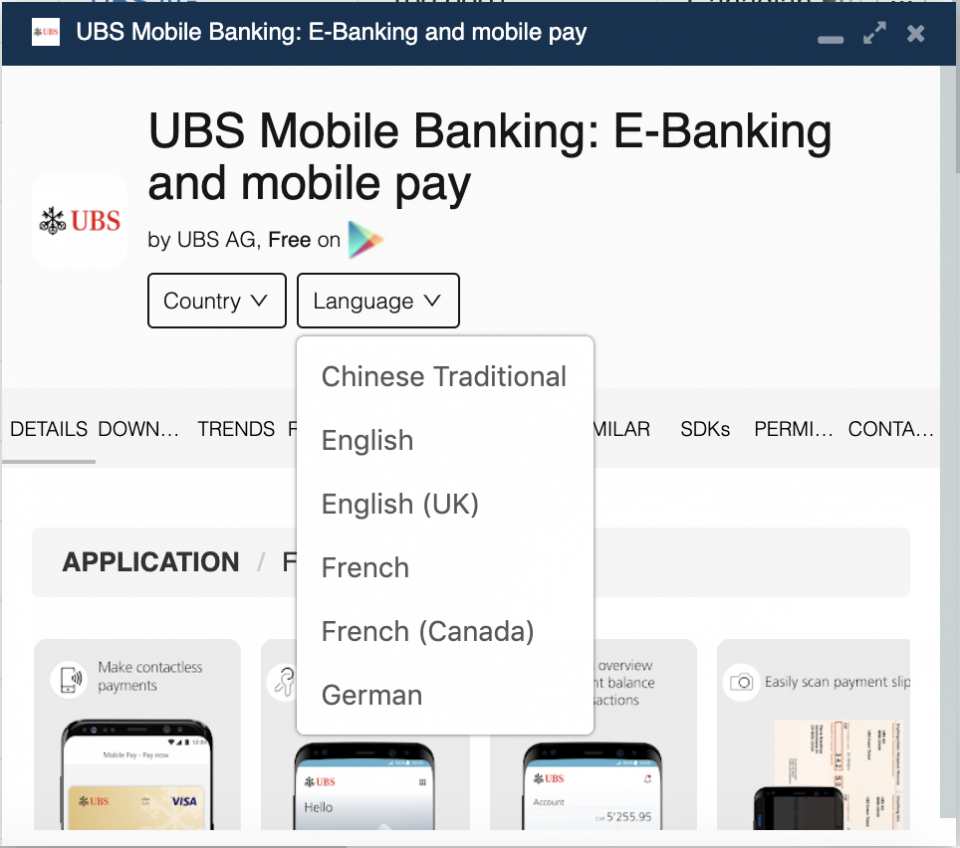

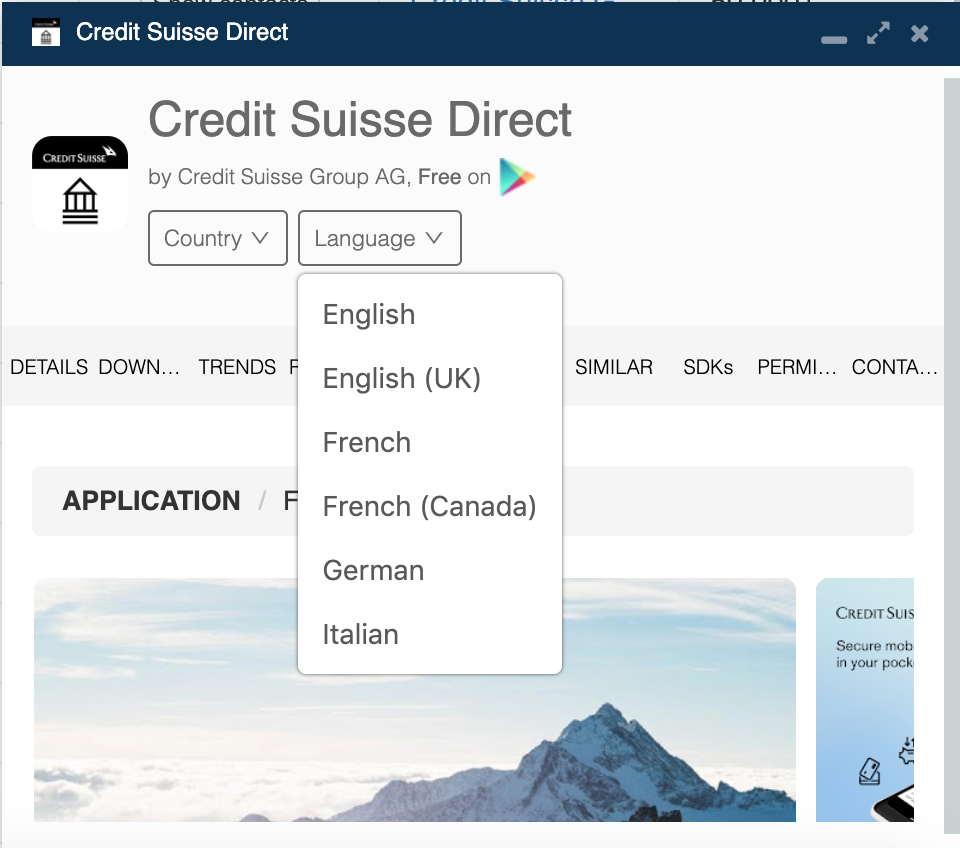

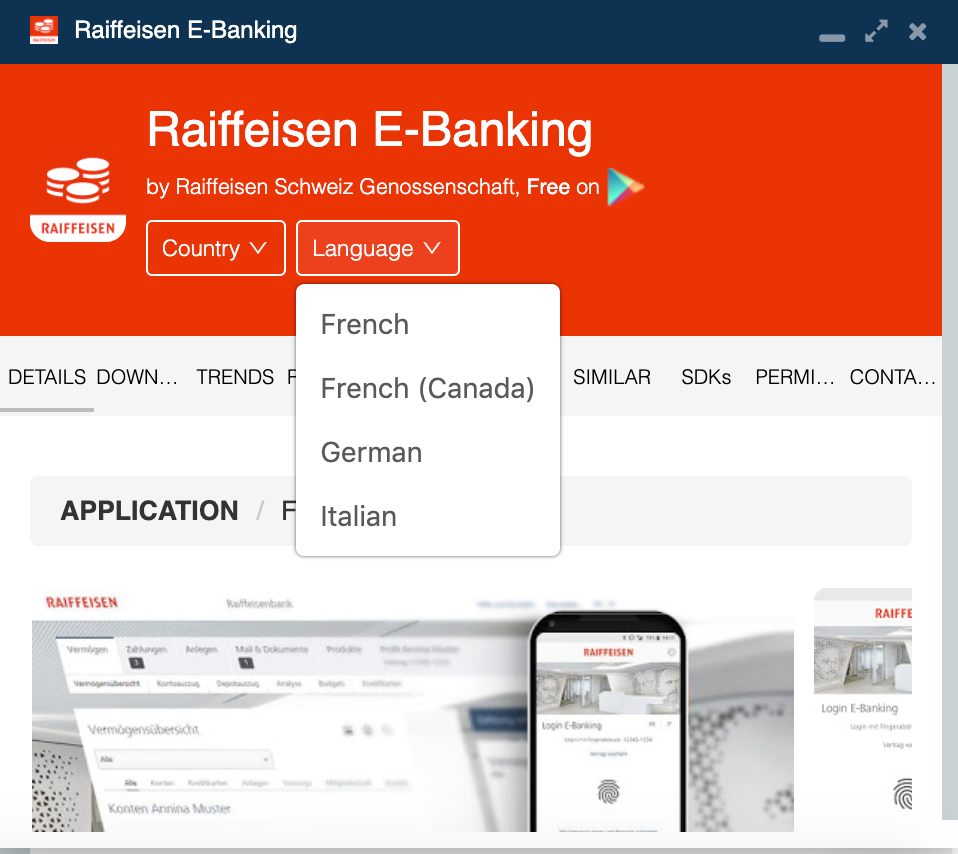

3. Compare Languages

Understanding which languages your competitors’ apps serve is a good way to gauge which markets they’re pursuing. For instance, it’s not uncommon for a US-based service to offer English and Spanish language options. However, if they’re also offering Finnish, you might want to do some digging — might Finland be a lucrative market for your financial app?

UBS, Credit Suisse, and Swiss Raiffeisen Bank are all fairly international brands. So, aside from the fact that Switzerland has four national languages, you’d expect to see a decent variety of language options. Here’s where to find this information on the 42matters Explorer. Please note that, because these are images, you cannot scroll down to see the complete list:

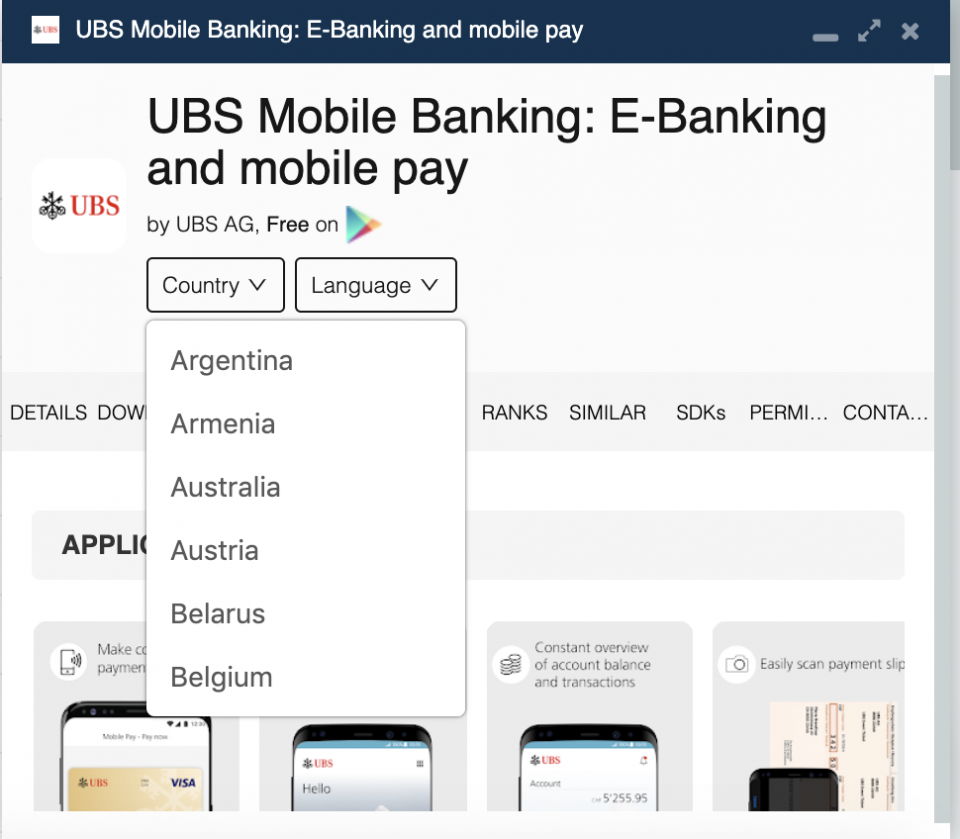

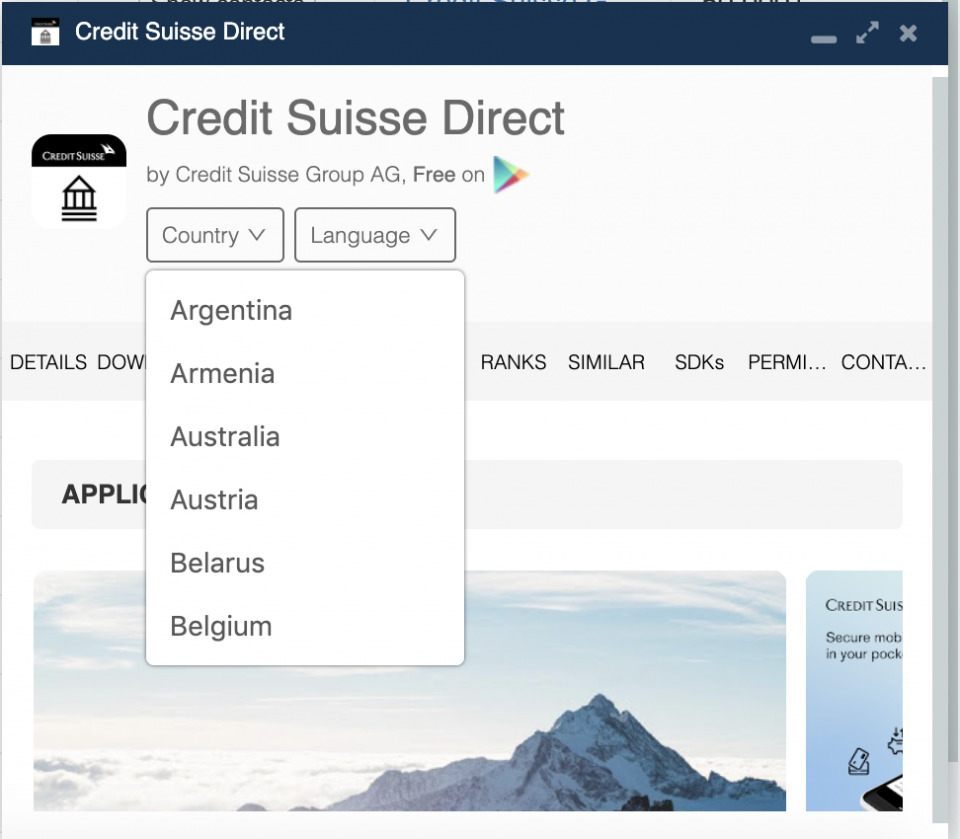

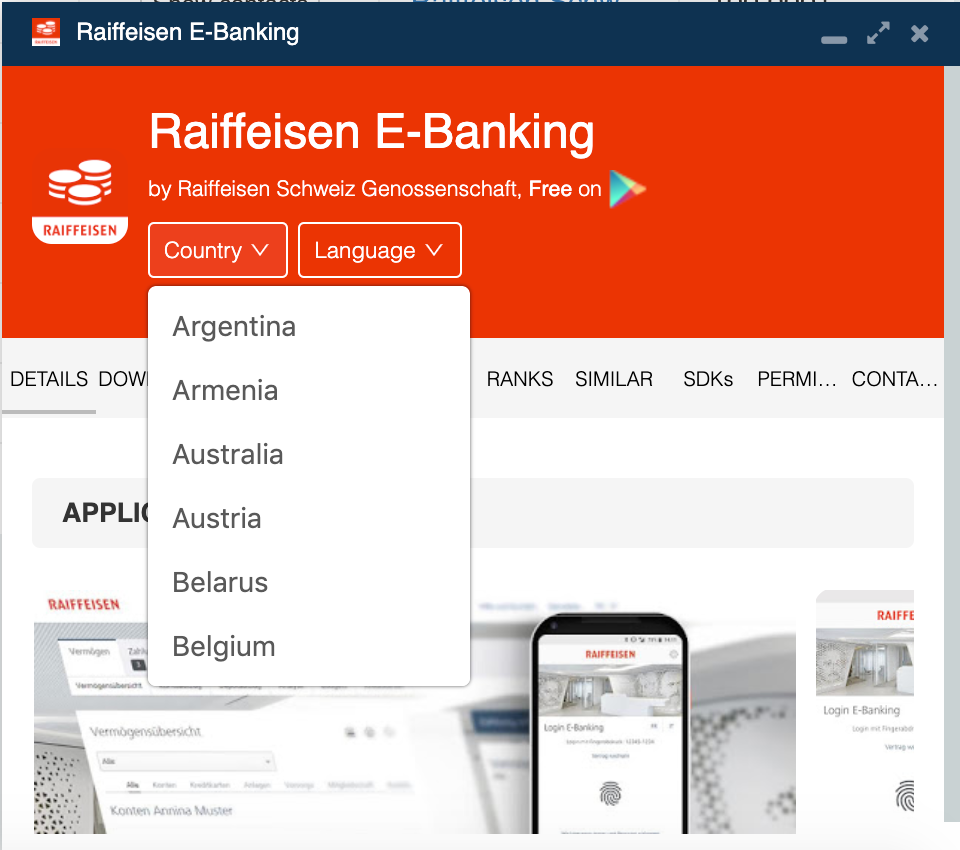

4. Compare Countries Where the App Is Available

Similar to language, country availability can be used to determine which markets an app developer is targeting. For banks, this will probably resemble their brick-and-mortar footprint pretty closely.

Here’s where to find the countries in which you can download the UBS, Credit Suisse, and Swiss Raiffeisen Bank apps. As before, these are images, so you cannot scroll down to see the complete list:

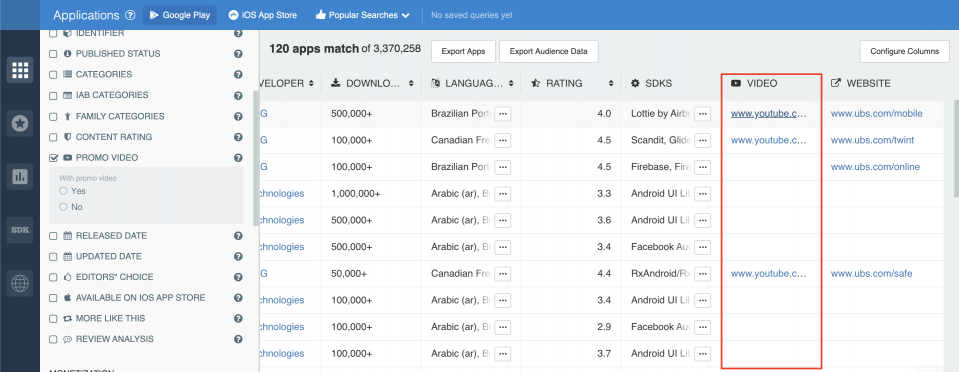

5. Promo Video

When it comes to promo videos, you get what you pay for. So if your competitors’ videos are well produced and hyper-focused on certain features or functionalities, you can be fairly certain that they’ve done their research and think it prudent to invest in promoting those aspects of their product. As such, promo videos are a reliable reflection of what they believe is most attractive about their products and who is most attracted by them.

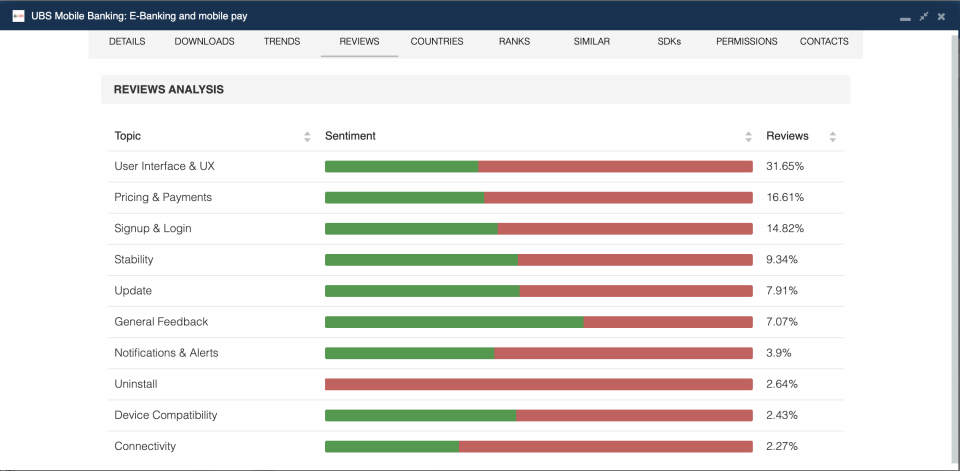

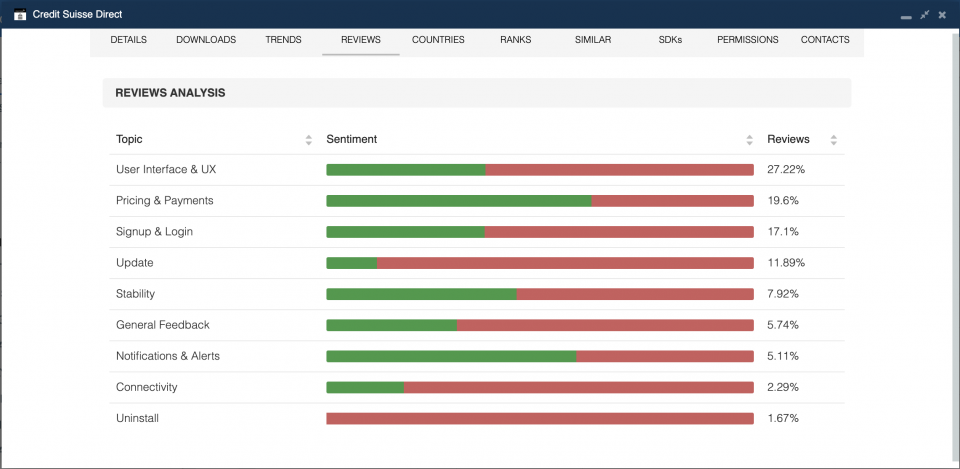

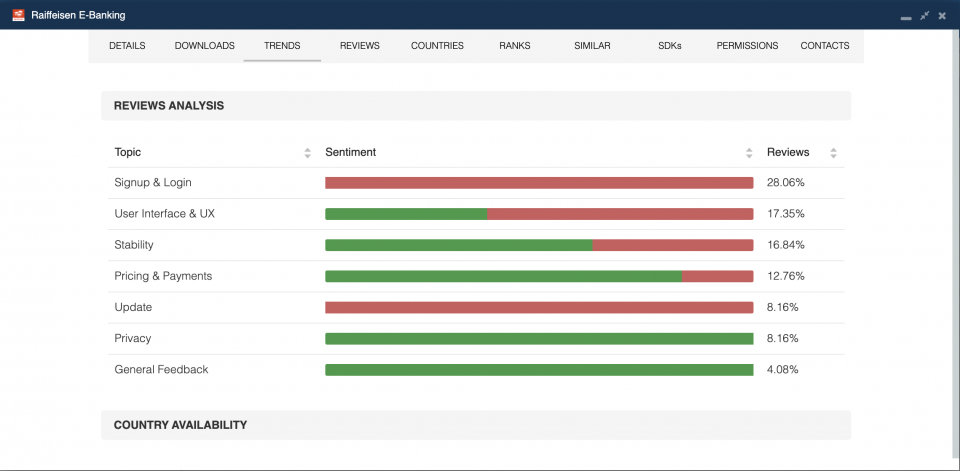

6. Review Analysis

Similar to changelogs, you can use app reviews to figure out what your competitors do well or poorly. This makes them a goldmine for your product and UX team. Indeed, with a coherent reading of your competitions’ reviews, you can better shape your user experience, app design, marketing message and define your product strategy.

To facilitate this, 42matters provides both a Review Analysis feature on the Explorer platform, as well as a corresponding Review Analysis API. Both enable you to analyze the review sentiment of your competitors’ apps. Here are the review analyses for UBS, Credit Suisse, and Swiss Raiffeisen Bank:

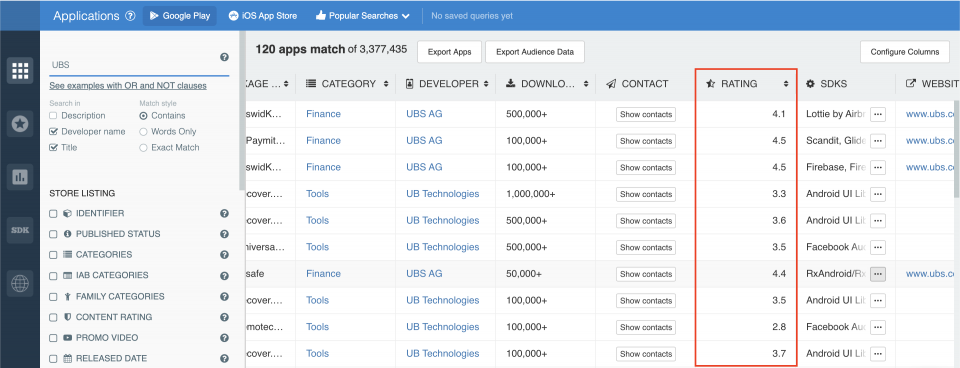

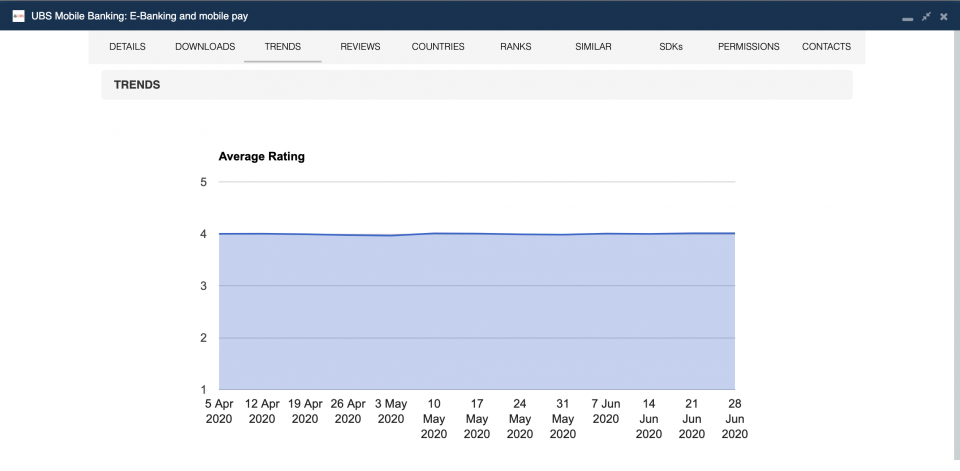

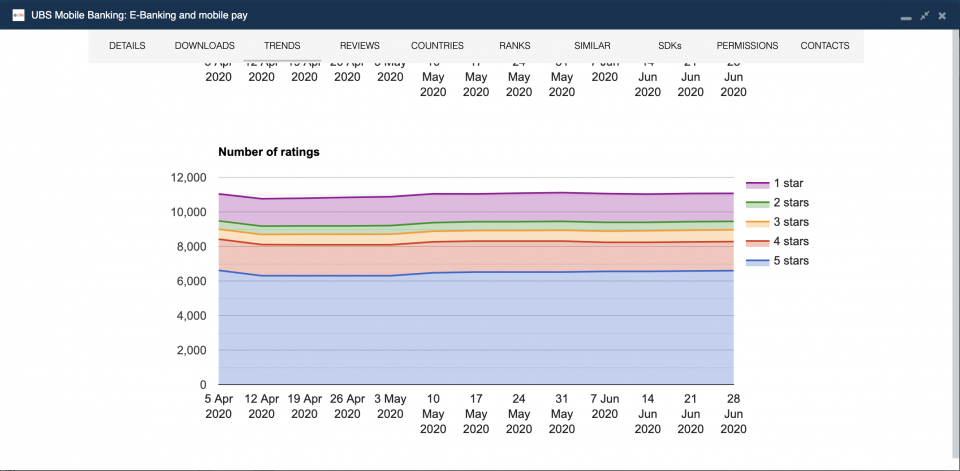

7. Ratings

Among the more straightforward ways of determining an app’s favorability is to look at its ratings. With 42matters, you can see not only how the average rating of your rivals’ apps have changed over time, but also how many ratings they have received. From there you can examine any trends that appear — sudden declines, sudden increases, etc. — and use the Explorer to figure out what might be causing them.

8. Available on iOS

Most apps these days are available on both iOS and Android devices. Of course, there are exceptions. For instance, since Google is banned in China, many apps built for the Chinese market are exclusively designed for iOS devices. If an Android version of a Chinese app appears, it might therefore be an indication that the publisher is targeting non-Chinese markets. Similarly, if an app was launched for Android devices only, the later appearance of an iOS version could signal that the publisher is undertaking a new venture.

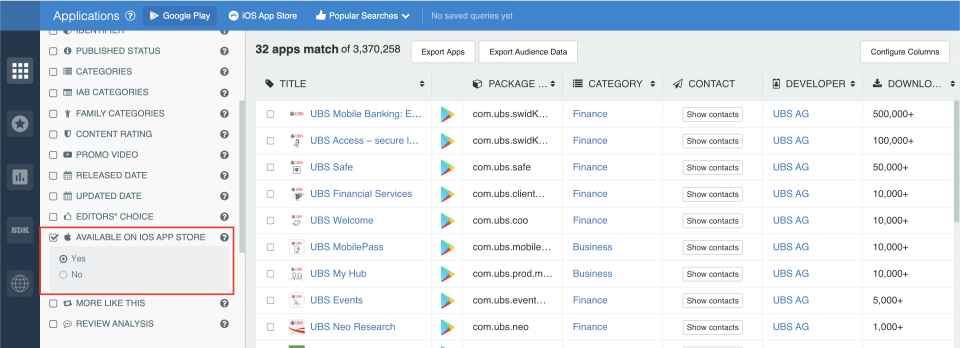

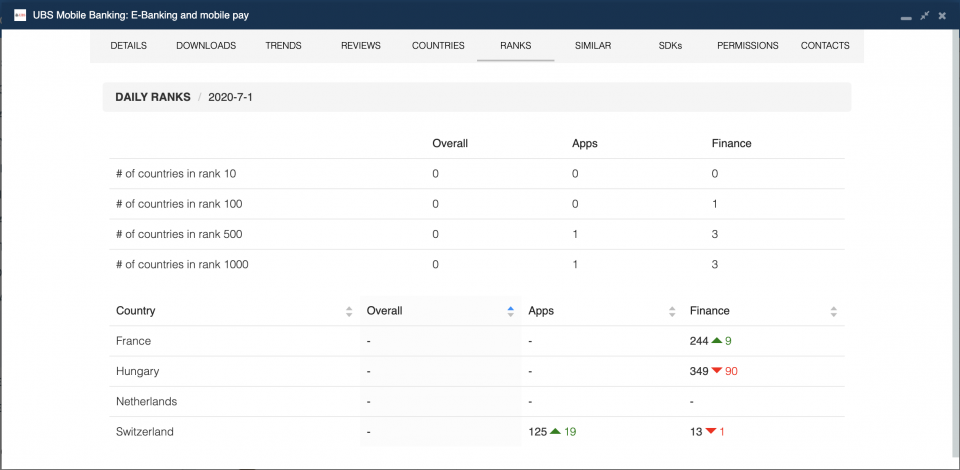

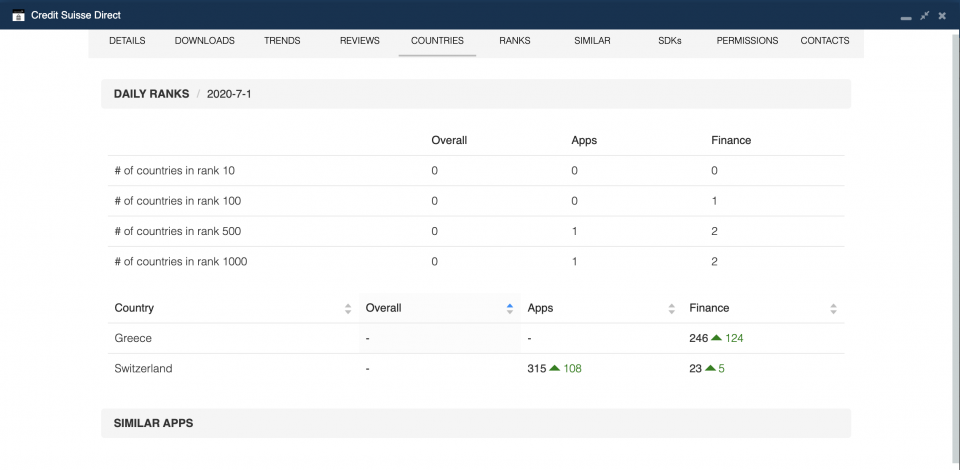

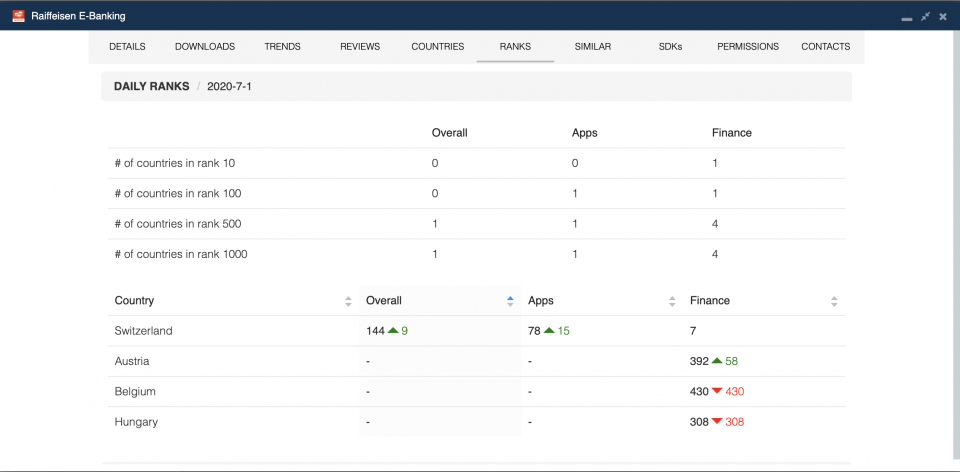

9. Selected Countries Ranking

42matters provides app rankings by country that allow you to see how you stack up with the local competition in your target markets. Moreover, these can be cross-filtered such that you aren’t comparing your app’s results with the likes of Facebook and Twitter — stiff competition for anyone.

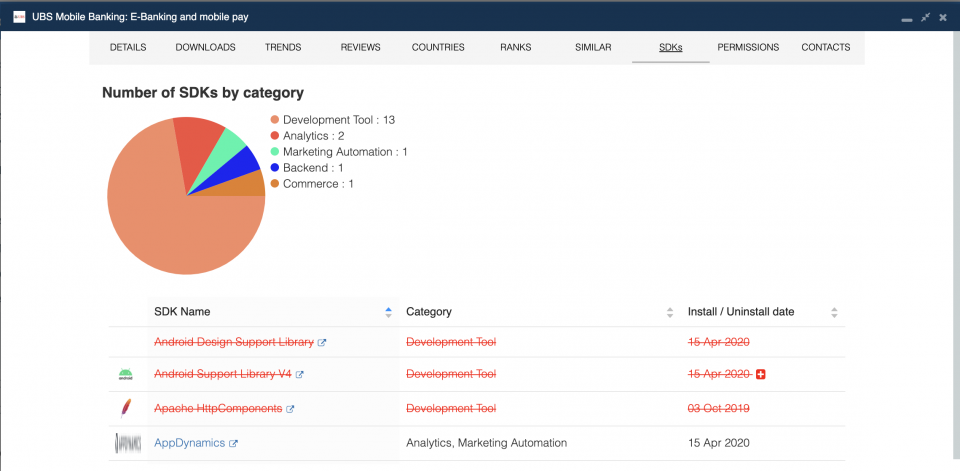

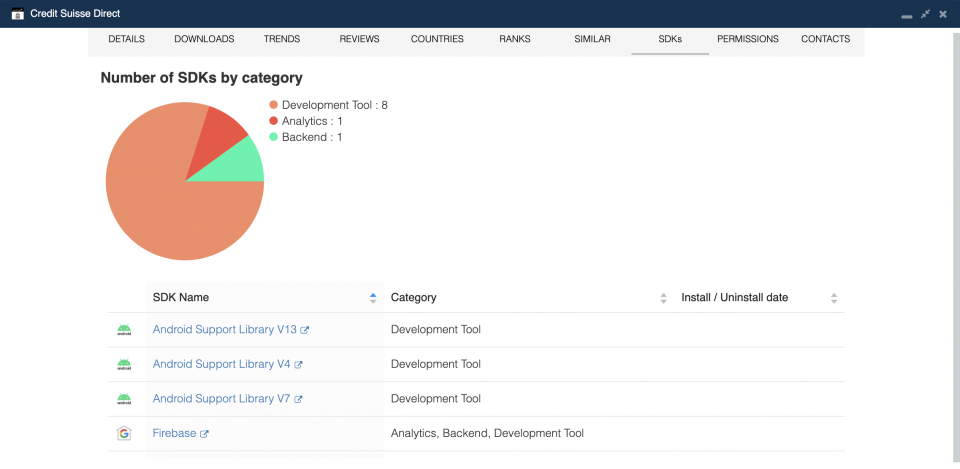

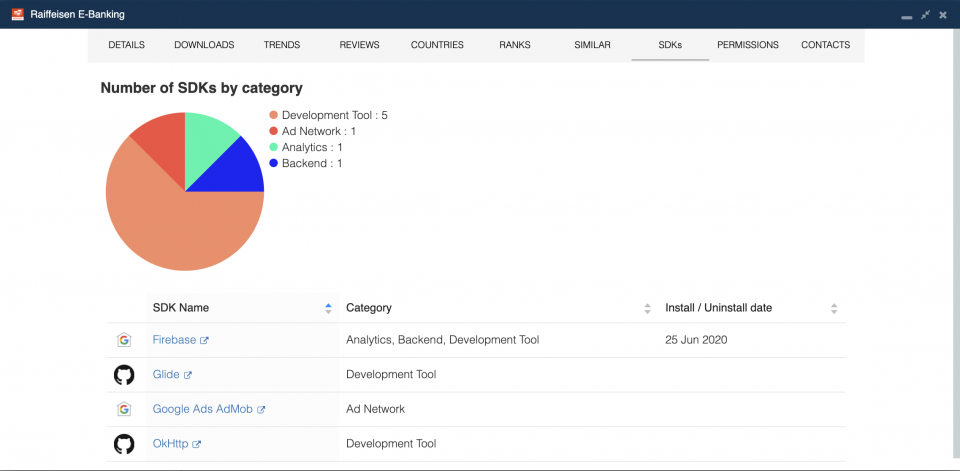

10. SDK Integrations

One of the simplest ways to improve your app is by leveraging an SDK. Whether you want to facilitate in-app messaging, in-app notifications, or in-app advertising, chances are you can find an SDK that will help you accomplish this.

However, with over 1,300 SDKs to choose from, it can be difficult to narrow your list down to the best options for your particular needs. One way to address this is to take a look at which SDKs your competitors are using. With 42matters, you can do precisely this.

What’s more, you can actually use 42matters to determine which SDKs your competitors have removed from their apps and cross check their SDK history with their review analysis. In this way, you’ll be able to determine which SDKs they’ve decided to drop, which they’ve decided to replace them with, and which might be driving negative sentiment amongst their users.

Here are the SDKs being leveraged by UBS, Credit Suisse, and Swiss Raiffeisen Bank:

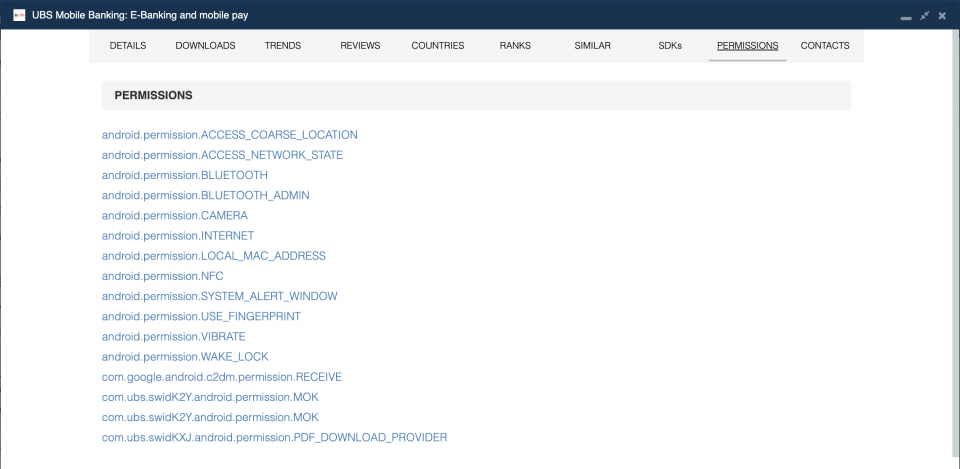

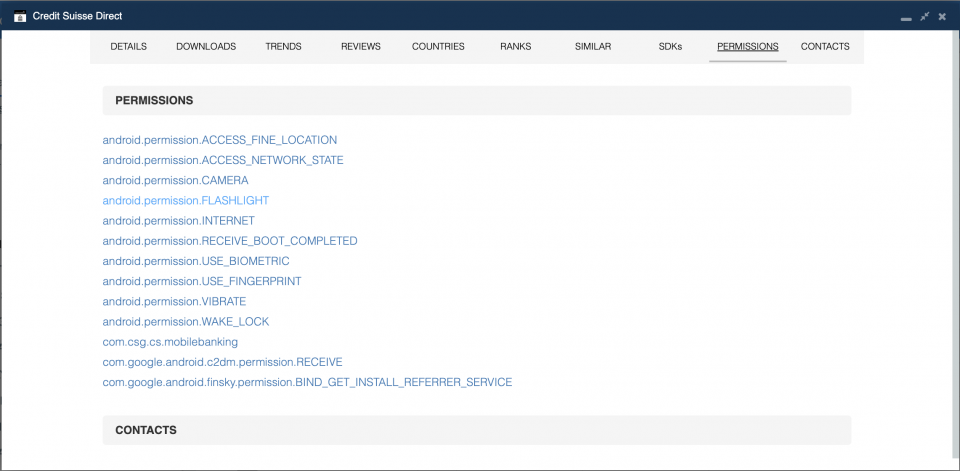

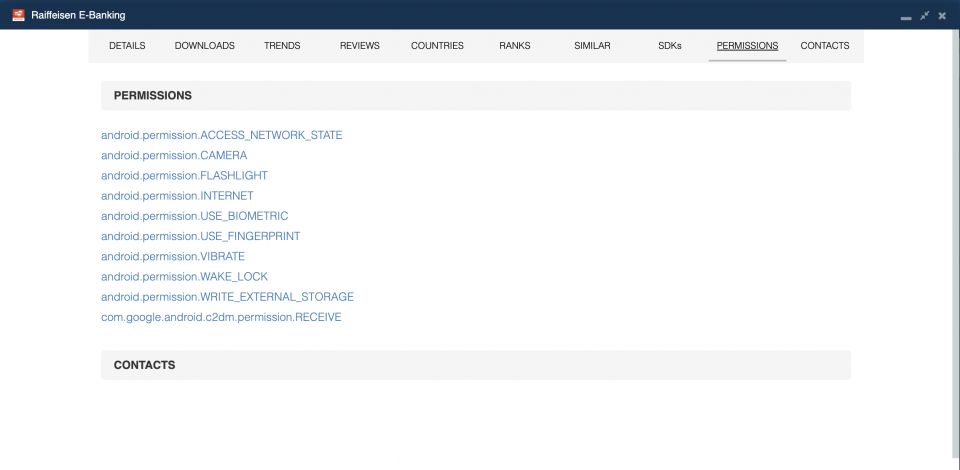

11. Technology Insights

Aside from SDK information, 42matters also provides other technology insights, like app permissions. By examining what your competitors’ apps are asking users to provide — location information, camera access, microphone access, etc. — you can get a good idea what it’s capable of.

Here are the permissions requested by the UBS, Credit Suisse, and Swiss Raiffeisen Bank apps:

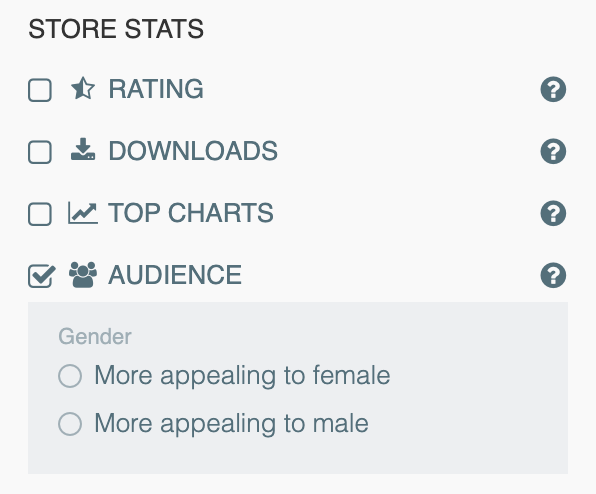

12. App Audience

Last, but certainly not least, 42matters provides app audience insights. With this, you’ll be able to approximate what your competitors’ user base looks like; thus, you’ll be able to ascertain what their average user looks like. This can help you define yourself either in opposition to them or as a similar institution with more to offer.

Here’s an example of the 42matters app audience filter:

App Market Insights from 42matters

For entrepreneurial start-ups looking to disrupt the financial sector, 42matters makes it possible to detect soft-spots in the market — where the top developers are struggling, which countries or regions are underserved, etc. For long-established financial institutions unenthusiastic at the notion of becoming tech companies, these products not only simplify decision making for the development of new apps, they also provide valuable competitor insights.

The 42matters Explorer, is an app market research tool that provides a comprehensive look at app trends and statistics. This includes data on both iOS and Android apps. Moreover, our APIs facilitate programmatic access to app intelligence data from both Google Play and the Apple App Store, as well as the Apple TV App Store, Fire TV, the Roku Channel Store, and more.

To learn more about what 42matters has to offer, schedule an appointment with one of our app market experts. We’ll walk you through everything.