Venmo, Cash App, and PayPal were the most popular “Personal Finance” Apps in the United States in November 2023. We breakdown the top 15 iOS and Android “Personal Finance” apps heading into the holiday season.

Welcome to the latest edition of our regular roundup of “Personal Finance” apps! We cover trends among the top American “Personal Finance” apps, as defined by the IAB’s cross-platform app content taxonomy. Come here for updates on the top performing apps in the United States, including download trends, monthly active user (MAU) insights, and more!

Here’s what we covered this month (click the links to jump to the corresponding section):

- Current Standings: iOS and Android Downloads

- Google Pay has an Apple problem

- Cash App, Venmo, and PayPal are the top performing ‘cross-platform’ apps

- Crypto apps are declining in the United States

- “Cash Advance” apps, like Brigit, Dave, and Empower, are rising

Want to keep an eye on the top personal finance, crypto, and banking apps? Try the 42matters App Watchlist for free!

Current Standings: Android and iOS Downloads

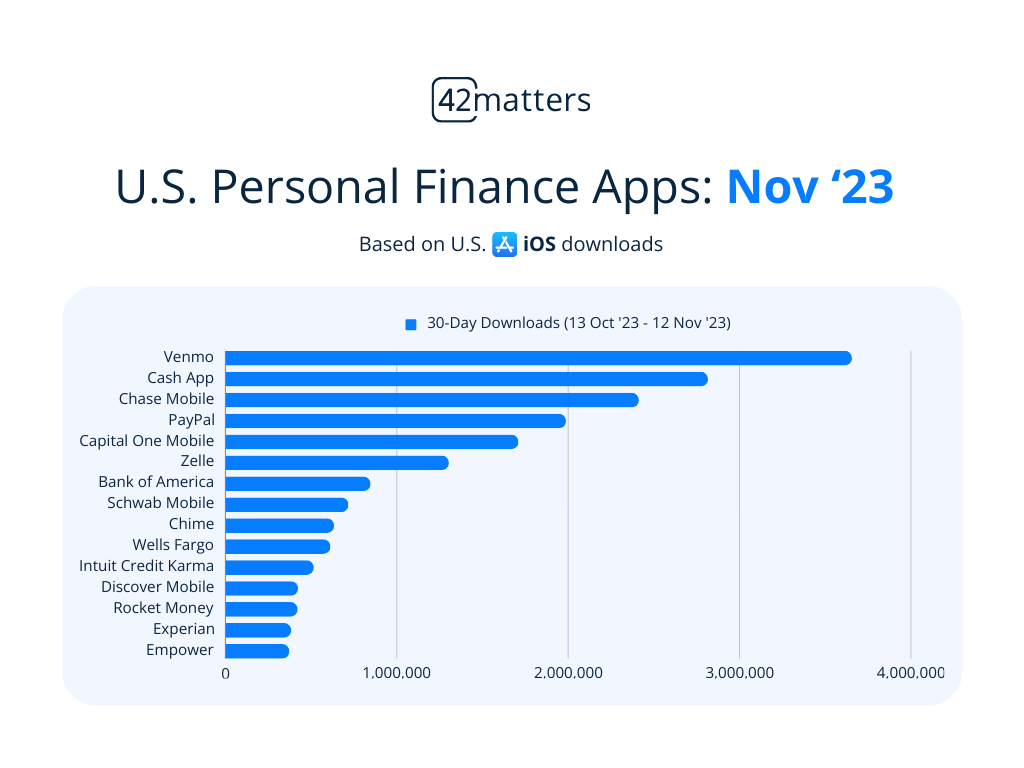

To begin, let’s look at platform-specific rankings for the month of November. Below are iOS and Android download counts for the top performing US-based “Personal Finance” apps. For each platform, we looked at the top 15 best-performing apps in the United States over the last 30 days. So, in this case, we looked at the period between October 13th, 2023 and November 12th, 2023.

First up, iOS…

iOS Downloads: October 13, 2023 - November 12, 2023

Venmo was the top performing iOS “Personal Finance” app in the United States. Americans downloaded it 3,656,424 times in the last month, which is nearly one million more downloads than the next closest app — Cash App. Check it out, here’s the full list:

- - Venmo: 3,656,424 downloads

- - Cash App: 2,816,437 downloads

- - Chase Mobile: 2,413,067 downloads

- - PayPal: 1,987,479 downloads

- - Capital One Mobile: 1,710,576 downloads

- - Zelle: 1,304,266 downloads

- - Bank of America Mobile Banking: 847,170 downloads

- - Schwab Mobile: 717,815 downloads

- - Chime: 634,542 downloads

- - Wells Fargo Mobile: 613,304 downloads

- - Intuit Credit Karma: 515,970 downloads

- - Discover Mobile: 423,770 downloads

- - Rocket Money: 421,816 downloads

- - Experian: 384,196 downloads

- - Empower: 373,243 downloads

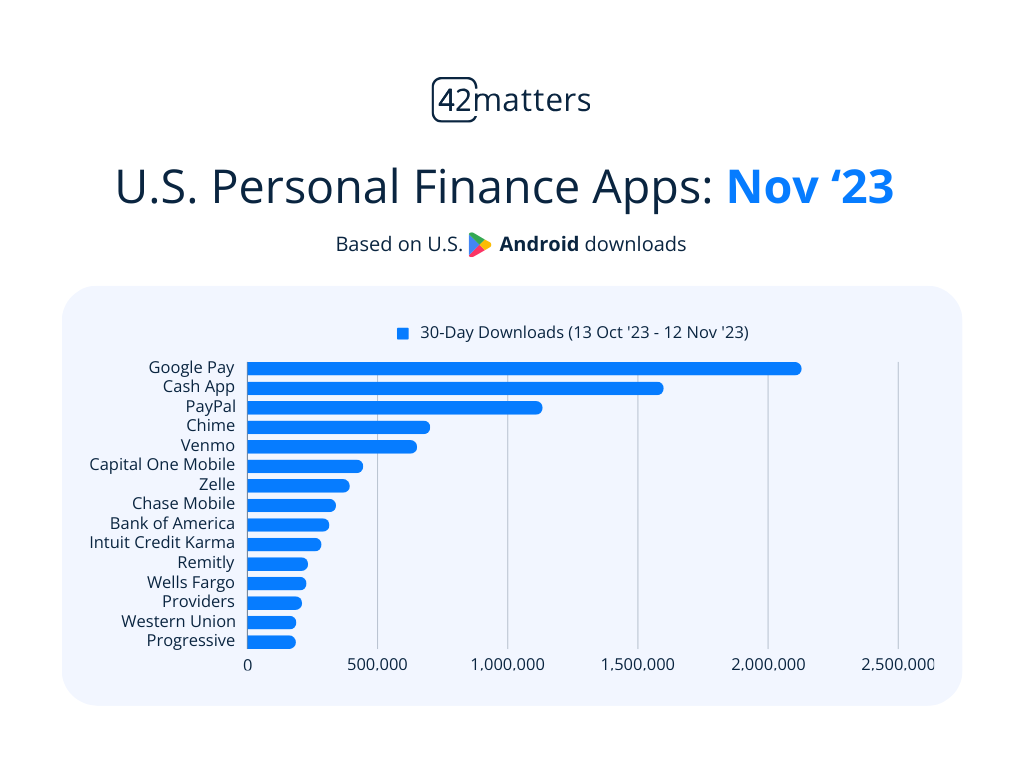

Android Downloads: October 13, 2023 - November 12, 2023

Now let’s turn to Google Play. Among Android “Personal Finance” apps, Google Pay had the most success in the United States. It was downloaded 2,129,364 times over the last 30 days. That’s roughly half a million more than Cash App, which had the next most downloads. Here’s the full list:

- - Google Pay: 2,129,364 downloads

- - Cash App: 1,599,244 downloads

- - PayPal: 1,134,428 downloads

- - Chime: 702,751 downloads

- - Venmo: 652,217 downloads

- - Capital One Mobile: 445,216 downloads

- - Zelle: 393,768 downloads

- - Chase Mobile: 340,699 downloads

- - Bank of America Mobile Banking: 315,499 downloads

- - Intuit Credit Karma: 285,130 downloads

- - Remitly: 233,591 downloads

- - Wells Fargo Mobile: 227,652 downloads

- - Providers: EBT, Mobile Banking: 210,464 downloads

- - Western Union Send Money Now: 188,425 downloads

- - Progressive: 186,516 downloads

Google Pay has an Apple problem

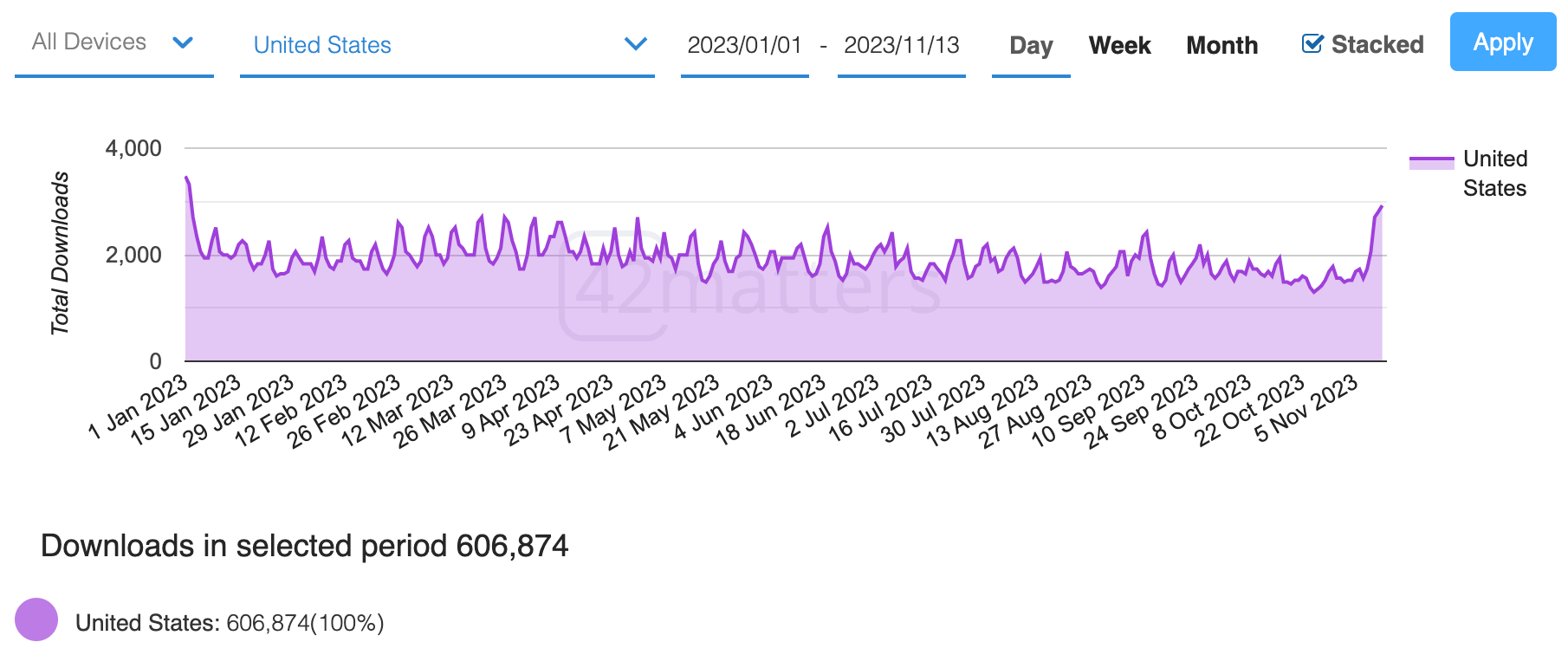

While Google Pay was easily the most popular ‘Personal Finance’ app among American Android users in November, it wasn’t particularly popular among iOS users. Indeed, despite a solid 2,129,364 downloads from Google Play over the last 30 days, it had just 50,089 on the App Store. Moreover, Apple users in the United States have only downloaded it 606,874 times in 2023 year-to-date:

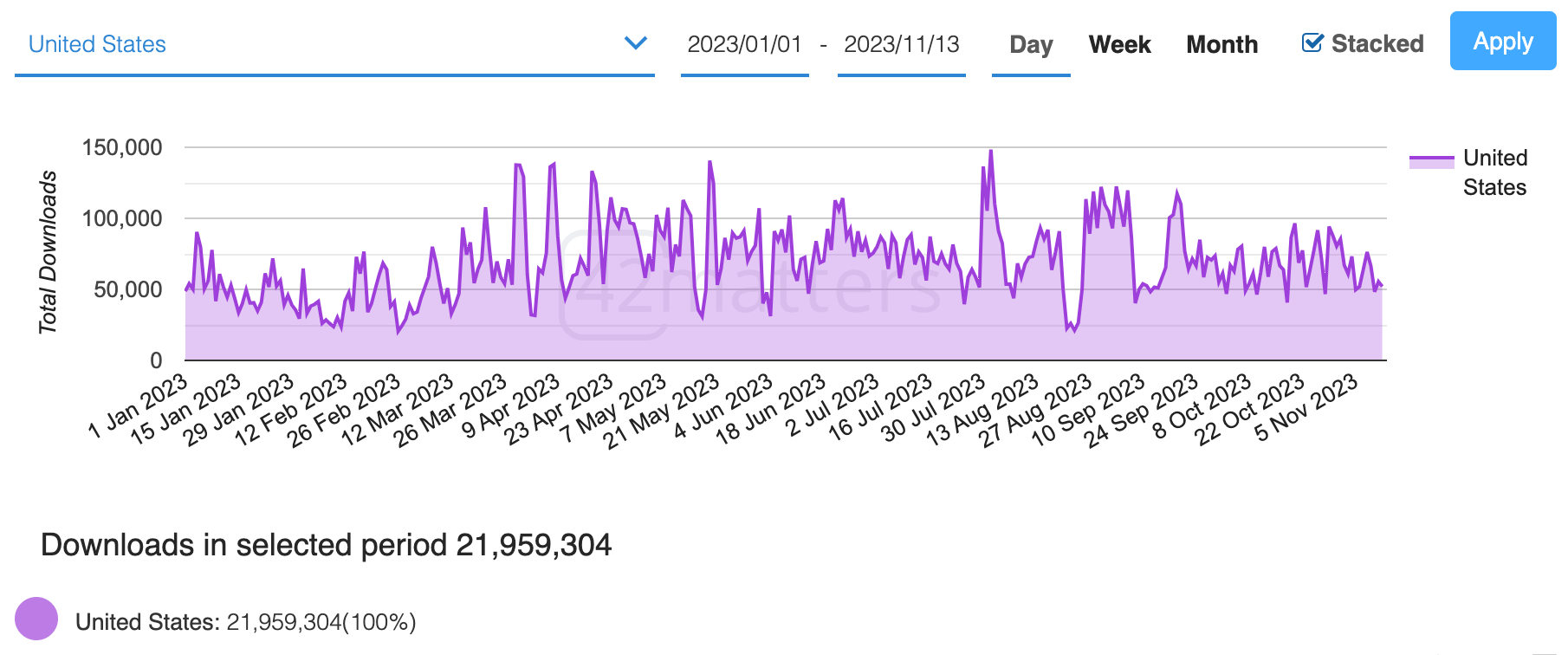

While this isn’t a dreadful performance, it’s pretty lackluster considering Google’s name recognition and the app’s popularity among Android users. For the sake of comparison, here’s what the 2023 year-to-date Android downloads look like:

21,959,304 downloads is pretty, pretty, pretty good.

Cash App, Venmo, and PayPal are the top performing ‘cross-platform’ apps

Okay, so clearly Google Pay dominated on Google Play. But its poor performance on the App Store means it's firmly in fifth place across both platforms. Cash App, Venmo, PayPal, and Chase Mobile have it beat.

The top three apps — Cash App, Venmo, and PayPal — were particularly strong performers, finishing the month with 4,415,681, 4,308,641, and 3,121,907 cross-platform downloads respectively.

Crypto apps are declining in the United States

The last time we put together our roundup of “Personal Finance” apps, Crypto was already showing signs of decline. Back then, Binance and Trust were the only crypto-focused apps that ranked among the top American “Personal Finance” apps. Today, things don’t look much better. Indeed, not a single app dedicated to crypto cracked the top 15. In fact, the best performing crypto app in the United States is Coinbase, which ranks 30th among “Personal Finance” apps on Google Play and 62nd among iOS “Personal Finance” apps.

“Cash Advance” apps, like Brigit, Dave, and Empower, are rising

Finally, there’s been a noticeable uptick in “cash advance” apps like Brigit, Dave, and Empower. While they haven’t quite cracked the top 15, they’re climbing quickly and more and more apps are leveraging the term as a keyword for app store optimization (ASO). So, it’s something to keep an eye on in the months ahead, especially as global economic concerns continue to grow.

Aside from the three already mentioned, others worth keeping track of are: Cleo, FloatMe, Klover, Beem, Cash Advance App, Borrow Money, and Gerald.

Final Thoughts

While Google Pay is a dominant presence on Google Play, Cash App, Venmo, and PayPal were easily the most popular cross-platform “Personal Finance” apps in the United States.

Interestingly, while Crypto apps continue to fade, cash advance apps are on the rise. Of course, it’s extremely difficult to infer anything concrete from these two trends. Nevertheless they provide an interesting glimpse into American economic sentiment.