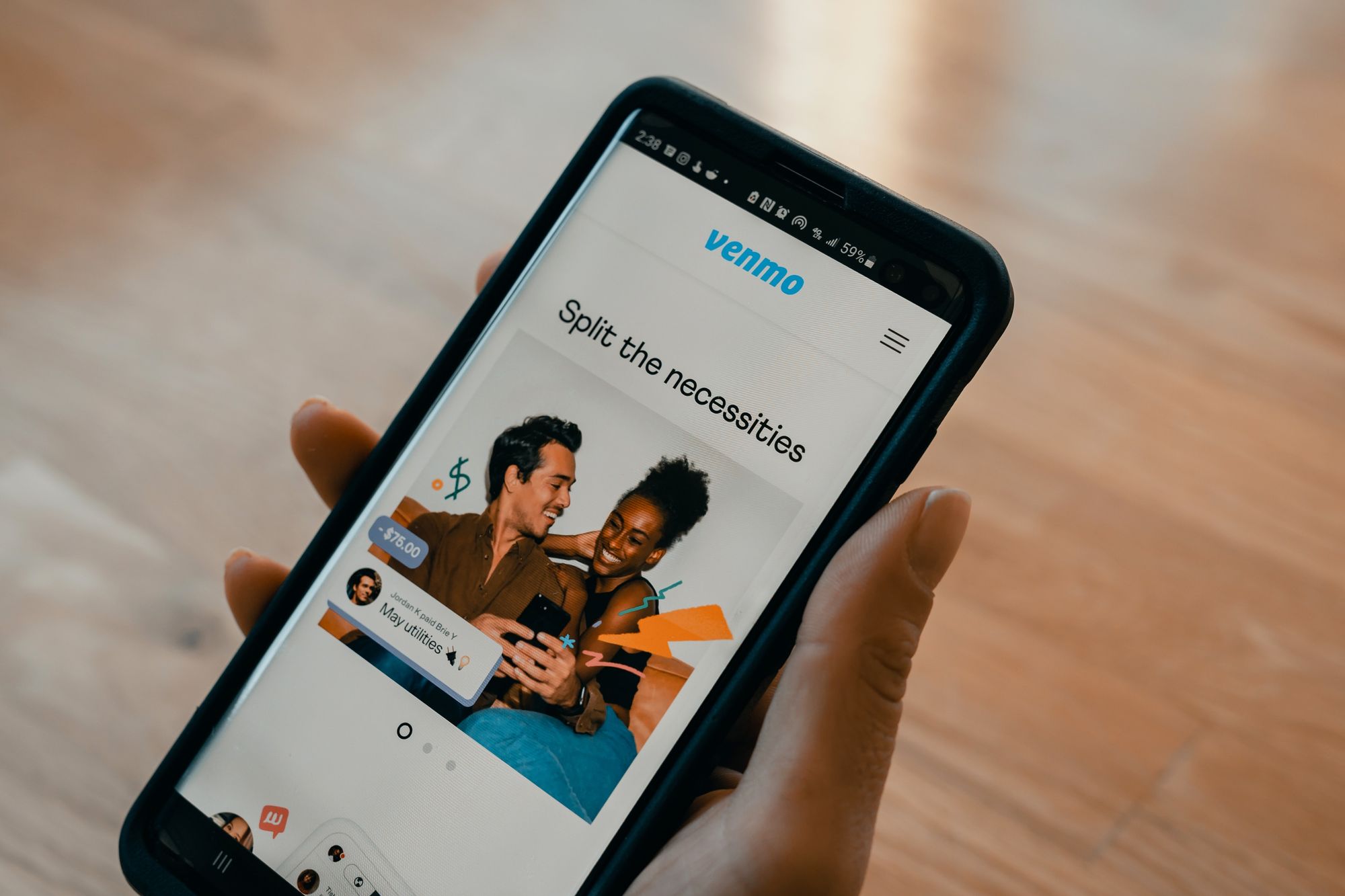

Buy Now, Pay Later apps were a big winner this holiday season, so we used our app intelligence to see how the top five BNPL apps performed over the break.

Last September, we wrote about the top five “Buy Now, Pay Later” (BNPL) apps in 2021, noting that, with growing concerns over inflation, general economic unpredictability, and a good deal of post-COVID belt-tightening, apps like Klarna and Afterpay would soon have a golden opportunity to test their mettle.

Well, it seems like we were on to something! BNPL apps had a moment this holiday season. According to PayPal’s CEO, Dan Schulman, the digital payment service saw a near 400% year over year volume increase for BNPL apps on Black Friday alone. This translated to some 750,000 BNPL transactions in a single day — not too shabby. But it didn’t stop there. According to C+R Research and Morning Consult, some 60% of American adults have used BNPL apps when buying products and of those who’ve used them, 80% planned on doing so for holiday gift-buying.

So, what does this mean for the apps themselves? Well, we used our App Watchlist platform, which is powered by our comprehensive mobile market intelligence, to track how the top five BNPL apps performed over the holiday season.

Here’s what we cover (click the links below to jump to the relevant sections):

The Top 5 BNPL Apps in 2022

1. Klarna | Shop now. Pay later. by Klarna Bank AB (publ)

- Short Description: Easy shopping, easy payments.

- Total Downloads: 10,000,000+

- Android Downloads Over the Last 30 Days: 2,836,070

- iOS Downloads Over the Last 30 Days: 2,505,710

2. Afterpay: Buy now, pay later. Easy online shopping by Afterpay

- Short Description: Buy online & pay later - browse the latest shopping deals in fashion & beauty.

- Total Downloads: 1,000,000+

- Android Downloads Over the Last 30 Days: 336,040

- iOS Downloads Over the Last 30 Days: 484,493

3. Affirm: Buy now, pay over time by Affirm, Inc

- Short Description: Split purchases into easy monthly payments.

- Total Downloads: 1,000,000+

- Android Downloads Over the Last 30 Days: 411,849

- iOS Downloads Over the Last 30 Days: 318,260

4. Sezzle - Buy Now, Pay Later by Sezzle

- Short Description: Buy now & Pay Later with Sezzle Payments.

- Total Downloads: 1,000,000+

- Android Downloads Over the Last 30 Days: 175,823

- iOS Downloads Over the Last 30 Days: 49,692

5. Zip previously Quadpay. Buy now, pay later in four by Quadpay, Inc.

- Short Description: Split any purchase into 4 installments. Zero interest, no hard credit check.

- Total Downloads: 1,000,000+

- Android Downloads Over the Last 30 Days: 96,771

- iOS Downloads Over the Last 30 Days: 91,411

Analysis of the Top 5 BNPL Apps During the Holiday Season

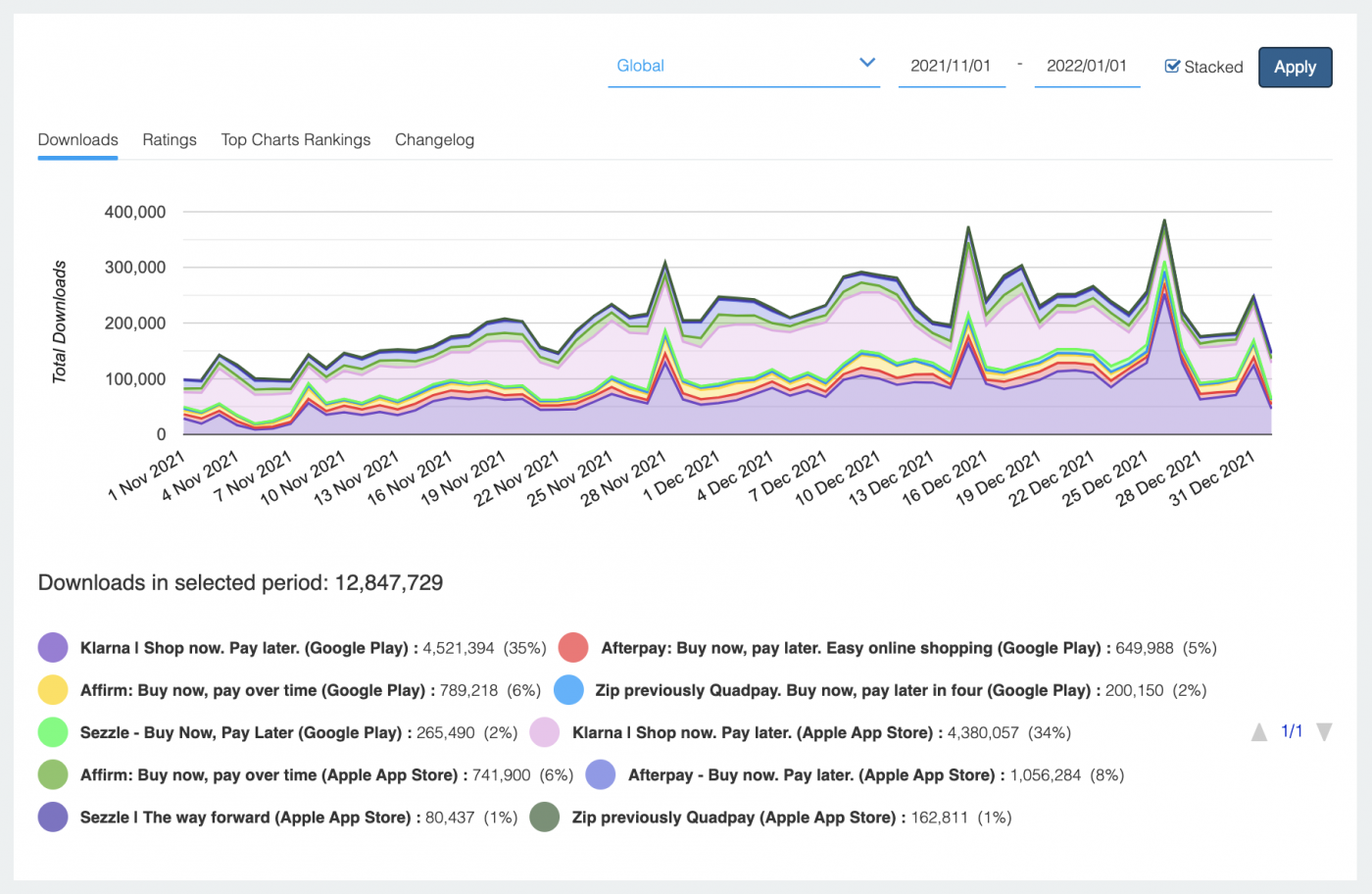

Downloads between November 1st, 2021 and January 1st, 2022

Above you will find global downloads for both the Android and iOS versions of Klarna, Affirm, Afterpay, Sezzle, and Zip from November 2021 until the new year.

As you can see Klarna was easily the most popular of the five Android apps, generating some 4,521,394 downloads in the selected time frame. Next came Affirm (789,218 downloads), Afterpay (649,988), Sezzle (265,490), and Zip (200,150).

Likewise, Klarna led the iOS apps with 4,380,057 downloads, followed by Afterpay (1,056,284), Affirm (741,900), Zip (162,811), and Sezzle (80,437).

But more remarkable is the fact that these BNPL apps seemed to trend in near complete lockstep, with concurrent spikes around Black Friday (November 26th), Cyber Monday (November 29th), mid-December, and Boxing Day (December 26th). Moreover, there’s a clear upward trend throughout the entirety of December (during Hanukkah and in the run-up to Christmas), and a precipitous decline heading into New Year’s Eve.

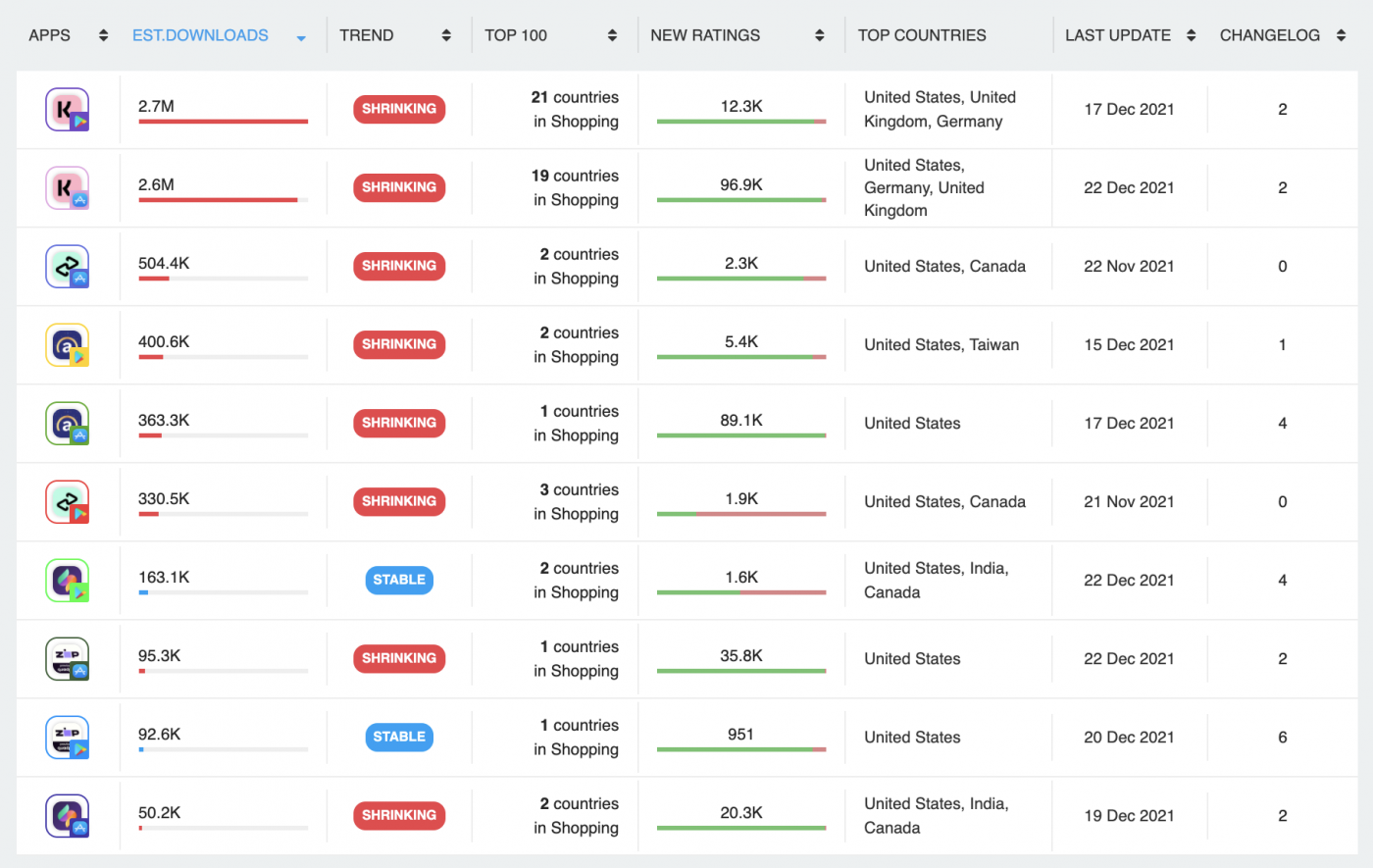

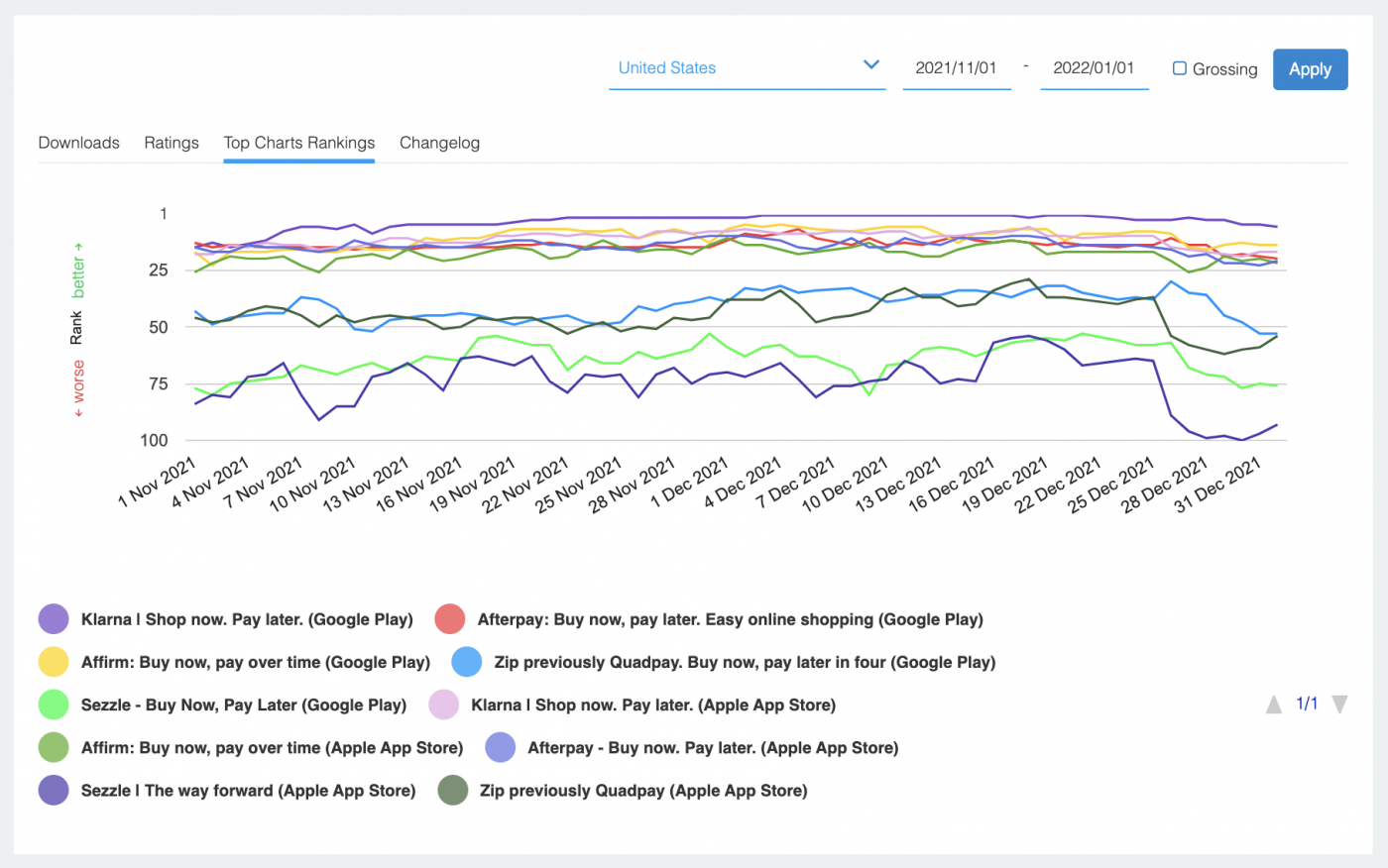

Top chart rankings between November 1st, 2021 and January 1st, 2022

Now let’s take a quick look at how these apps performed in Google and Apple’s top chart rankings in the same time period. In this case, we’ll be looking specifically at the United States.

Klarna was the big winner among the Android apps, peaking at number one in the Shopping category from December 3rd to December 17th, and then again from December 19th to December 21st. Affirm, meanwhile, peaked at fifth in the shopping genre on December 2nd. Afterpay peaked at 7th (December 5th), Zip at 30th (December 26th), and Sezzle at 53rd (November 30th, December 21st).

Klarna, led the iOS apps here as well, ranking as high as 6th in the Shopping genre on December 18th. Then came Afterpay at 10th (December 11th, December 17th - 18th), Affirm at 11th (December 11th), Zip at 29th (December 18th), and Sezzle at 54th (December 18th).

That said, Google and Apple aren't too transparent about which metrics are considered when ranking apps in their top charts. Nevertheless, metrics like downloads, ratings, and user retention are almost certainly part of the equation. As such, these rankings indicate that the top BNPL apps closed out 2021 in a big way.

Final Thoughts

As we noted in our September blog post on the topic, the BNPL app landscape is still quite young. Klarna, Afterpay, Affirm, Zip, and Sezzle still make up roughly 70% of the current market. But if the past couple years have taught us anything, it’s that things can change — and often do so quickly.

While Klarna retained its place at the head of the BNPL table throughout the 2021 holiday season, there’s no guarantee that that will always be the case. Indeed, back when we wrote our last analysis, the Android version of Afterpay was firmly entrenched in the second place spot. It had received 408,175 downloads in the 30-day period we analyzed. Meanwhile, the Android version of Affirm registered just 174,721 downloads in the same time frame. Fast-forward to today and things are little different, with Afterpay notching some 336,040 downloads over the last 30 days, compared to Affirm’s 411,849.

All this is to say that the Buy Now, Pay Later market is one that should be monitored closely. While the holidays were a great test, BNPL apps are not seasonal. They’re capable of facilitating unique, year-round benefits to billions of people all over the world. And, with potentially difficult economic times looming in 2022 and beyond, they may play an even bigger role in the global economy in the years to come.